Bond guru and head of DoubleLine Capital gave an interview with Barrons over the weekend. Sharing his thoughts on a variety of factors ranging from the Brexit fallout to the upcoming US elections, Gundlach maintained his views that gold prices are more likely to go higher. He said, “Gold miners have a very high probability””if you bought them today and were disciplined””of making 10%. There’s an 80% chance of making 10% in gold; the probability of a 10% gain on Treasuries is 20% at best.”

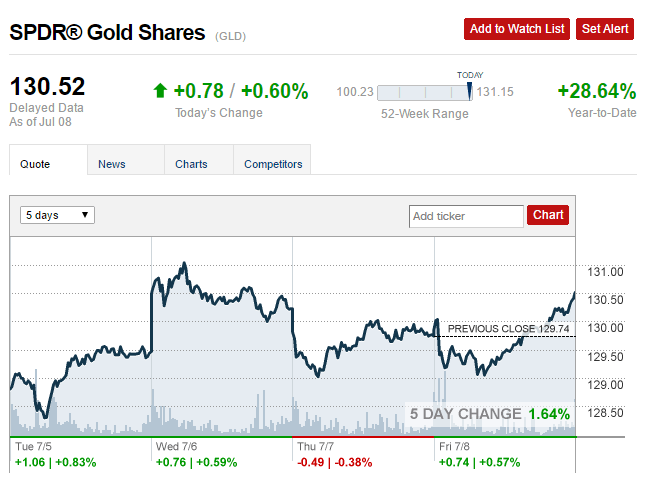

Last week, the risk aversion in the markets was back with gold prices seen surging to new one-year highs. Comex gold futures closed the week at $1358.4 an ounce, after a brief pullback from the highs of $1377.5. Price broke above 2015 highs of $1307.8 and is now likely to challenge 2014 highs of $1392.6.

Investors ignored last Friday’s payrolls report, which showed that the US economy added 287k jobs, beating estimates of 178k – 180k jobs and reversed May’s dismal job growth which was revised to 11k, from previous estimates of 38k. The risk aversion prior to the jobs report also sent the bond yields to record lows. The US 10-year Treasury yields closed on Friday at 1.358%, marking a new all time low. It was the same story in other parts of the developed economies, underlining the fact that investors preferred to seek out the safe haven status of bonds and gold prices.

The rally in gold this year has been phenomenal. Gold, which was only trading at $1060.2 in December, rocketed after the Fed hiked rates by 25bps in December. The strong rally recorded in January and February this year sent gold prices rising to $1234. Despite an odd two months of pullbacks, gold prices resumed their gains. This has led to many analysts forecasting that gold prices could be seen trading at $1500 an ounce in the near future. Gundlach, one among the many, went on to say that the dead-money portfolio was the S&P500. A view shared by the likes of George Soros who, a few months ago said that he was short on the S&P500 while showing preference for gold.

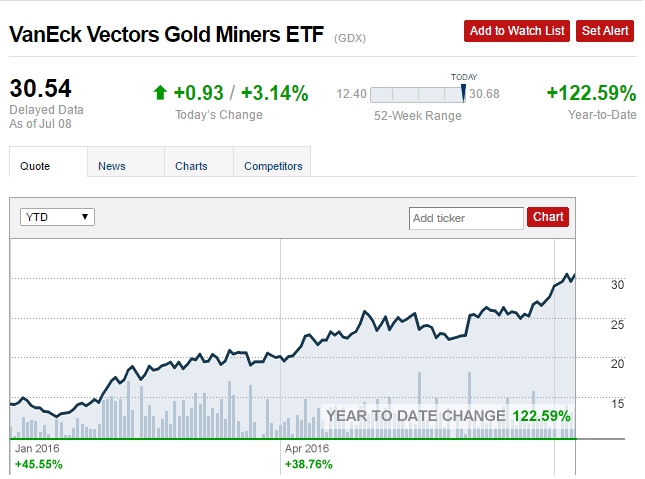

The VanEck Vector Gold miners ETF has given an impressive 122.59% on a year to date basis, closely tracking and outperforming gold’s own gains of over 28.13%. In the near term, the fundamental landscape shows that global monetary policy is likely to remain in favor of gold. With the Bank of England sooner than later likely to cut interest rates and potentially expand its QE purchases; the Bank of Japan is also likely to join the QE club with expanding its already burgeoning monetary base. The ECB, although at a pause temporarily is also expected to expand its bond purchase program, especially after the UK deciding to part ways with the EU.

VanEck Vector Gold Miners ETF (GDX) Ytd performance – 122.59%

UBS strategist Joni Teves, in a research note said that the average price of gold ovr 2016 is likely to be around $1340 an ounce with short term rallies likely to test $1400 per ounce. She said, “Key drivers include: 1) low/negative real rates, 2) the view that the dollar has peaked against DM currencies, and 3) lingering macro risks.” Coming in close was HSBC who now increased their gold price forecasts to a more conservative $1250 average price for 2016. Although conservative, it was only last year that many expected gold prices to fall to lows of $1000 an ounce.

The current monetary policies combined with the prevailing uncertainty in the global markets is therefore likely to see gold prices elevated over the next few months and could possibly validate Gundlach and other institutional banks’ views that gold could be looking at another quarter of making fresh gains, in what could potentially result as one of the best performing asset this year.

Guest post by Andreas Pavli of http://www.AllFxBrokers.com