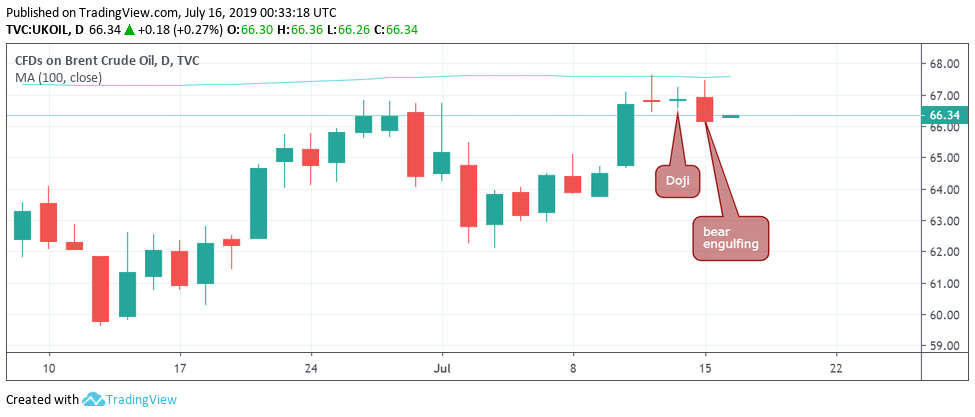

- Brent created a bearish engulfing candle on Monday.

- The daily chart now favors a drop below $66.00.

Brent is looking south and could drop below $66 in the next few hours, having charted a bearish candlestick pattern on Monday.

The black gold fell from $67.46 to $66.14 yesterday, engulfing Friday’s minor Doji candle, a sign of buyer exhaustion. It is worth noting that Thursday’s candle was also a Doji which marked rejection at the 100-day moving average line.

The back-to-back Doji candles followed by a bearish engulfing pattern indicates a short-term bullish-to-bearish trend change.

As a result, Brent could drop to $65.30 during the day ahead. On the higher side, a daily close above Monday’s high of $67.46 is needed to invalidate the bearish setup.

Daily chart

Trend: Bearish

Pivot points