A rising dollar once again! Would that be good or bad for the US economy?

As Britain voted on June 23rd to part ways with the EU, besides the yen and the gold safe havens, the US dollar also emerged as one of the beneficiaries. While the recent Fed rate hike narrative has been the main theme dominating the US dollar, the Brexit theme and the global repercussions could however shift the narrative.

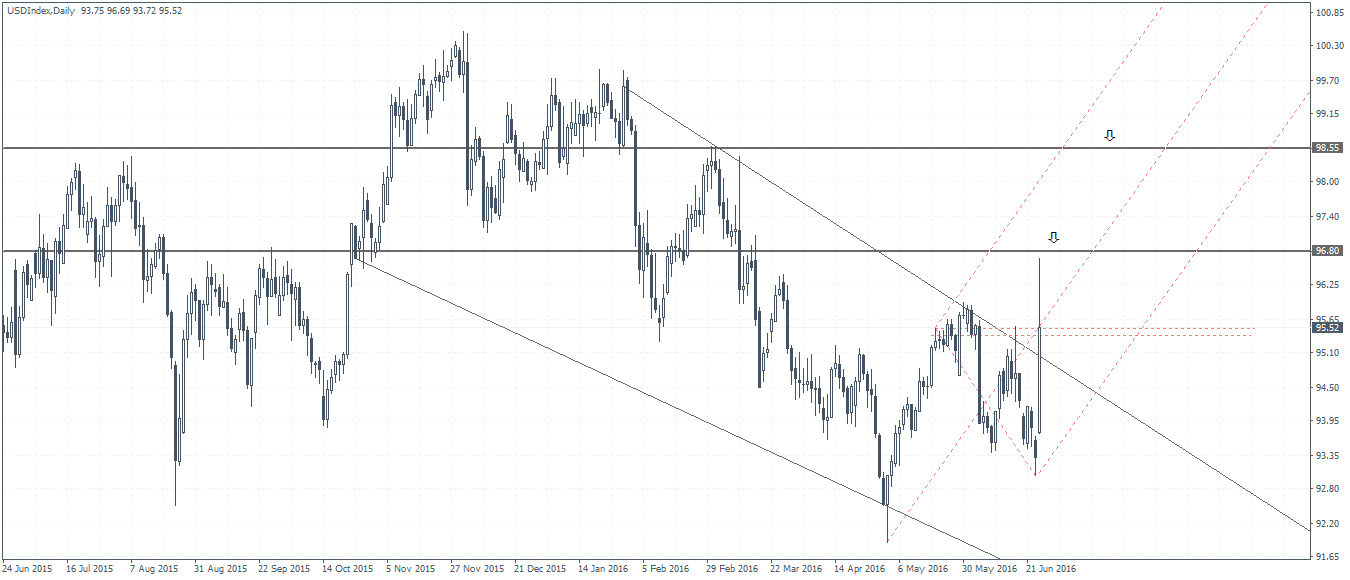

The ICE futures, US dollar index is currently up 2.25% after the official polls showed that the UK was leaving the EU with a majority vote of 51.90%. The dollar index has been in a somewhat downtrend since November last year with the trade weighted index falling to 1-year lows only a few weeks ago.

The Federal Reserve also changed its rhetoric since it met in early June. Following the dismal jobs report in May and the downward revisions to the April and March reports, the Fed opted to leave interest rates unchanged and reiterated that rate hikes would be ‘gradual’ and accommodative. For the moment, the Fed projects two rate hikes this year, but markets are expecting to see only one. That was until before the Brexit. With the uncertainty on how the UK will negotiate its way out of the EU, the Federal Reserve is likely to stand by without having to tighten the global financial markets already.

The US dollar is therefore most suited to seek out strong gains in the near term with the likelihood of a move back to 98.55 or even higher. This could mean that the commodity risk currencies such as the AUD and the NZD could start to decline in the near term, while the euro and the sterling are more likely to remain volatility until the Brexit cloud passes and there is a clear agenda and a timetable for exiting the EU.

The technical chart for the US dollar shows prices trading within the large descending wedge pattern. Following the dip to 92.20 in mid April, prices rallied to the highs of 95.65 before falling back lower to 93.35, marking a higher low. The current daily session is looking to make a breakout with minor resistance seen at 95.50 – 95.25. A successful breakout from this resistance could keep the dollar index well supported to the upside, with an initial target to 96.80 followed by a move to 98.55.

What currencies are most ideal to trade the dollar strength?

The euro is likely to remain subdued in the near term as the dollar index’ largest trade weighted currency. Further downside in the euro is very likely as long as there are no further policy surprises from the Federal Reserve. The impact of the Brexit is also likely to hit the EU as well, which could see the ECB keep its options open for further easing. It was only last week that ECB President Mario Draghi at a speech in Brussels mentioned that the ECB can expand its monetary policy if need be and when it seems appropriate.

The AUD and NZD are also likely to depreciate against the US dollar in the near term. While the RBNZ has held rates steady, there is scope for another 25bps rate cut as early as August and September. With the Brexit likely to hit the global markets hard, the RBNZ could opt for cutting rates further, keeping NZDUSD well pressured to the downside.

Last but not the least, the Australian dollar could remain weaker to the downside, but with a change of guard at the RBA it is most likely going to be a wait and watch for the moment.

Guest post by Andreas Pavli of http://www.allfxbrokers.com