EUR/USD is weakening on Draghi’s determined words and his call for fiscal and monetary stimulus. Can the pair rise back up? Here is the view from Credit Suisse:

Here is their view, courtesy of eFXnews:

Currency investors should consider buying EUR/USD this week, advises Credit Suisse in its weekly FX pick to clients. The trade is macro-technical driven.

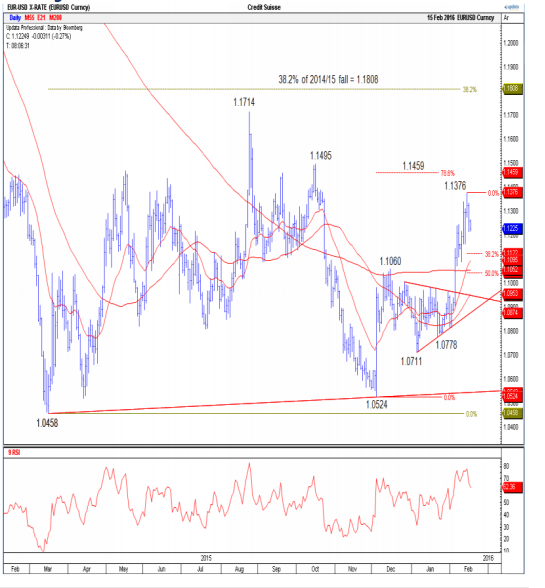

“Our technical analysts are long EURUSD on a tactical horizon, looking for fresh buying around 1.1162/54 to 1.1300 and then 1.1376.

We are hesitant to chase typical risk-on trades in G10 FX this week, and would stay cautious in holding longs in currencies like GBP where there are also conflicting and uncertain political and data risks,” CS argues.

On the technical front, CS notes that EURUSD has seen a decline, turning the attention onto 13- day average at 1.1162/54 which the pair is currently hovering around and should keep the immediate bias topside.

“Resistance moves to 1.1300, followed by 1.1376/87. Above the latter is needed see a tougher test at the 78.6% retracement of the August/December fall and the October 2015 peak at 1.1459/95.

We would expect this to cap at first, and above it is needed to turn attention on the August 1.1714 peak, followed by the 38.2% retracement of 2014/15 fall at 1.1808,” CS adds.

CS maintains a long EUR/USD position as a technical-tactical trade from 1.1155 targeting a move to 1.1450, with a stop at 1.1054.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.