Tension is clearly growing towards the March meeting of the European Central Bank, with even some hawkish members talking about their readiness to act. How should one trade it? Here is the word from Bank of America Merrill Lynch:

Here is their view, courtesy of eFXnews:

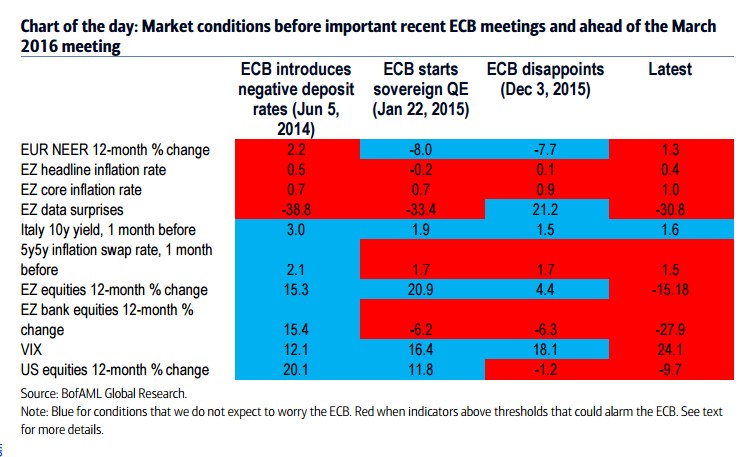

We argue the March ECB meeting could be the most difficult in recent years and that more easing could be unable to have a sustained market impact. In contrast to the recent past, the ECB is now dealing with global shocks, which are much more difficult to address. The ECB has to think outside the box, but we do not expect it to. Markets could be disappointed, although for different reasons from those in December.

Our strategy remains to trade the Euro tactically. We expect the Euro to weaken further ahead of the ECB meeting, as the bear market rally continues and investors position for more ECB easing. We would also expect Draghi to do his best to avoid another market disappointment. However, we do not expect that more of the same would be enough to offset the global forces that have been driving the Euro this year.

We would buy the Euro dip after the ECB meeting, or even before if markets overshoot. In a bear market, we expect global forces to be a stronger driver for the Euro than monetary policies.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.