There seems to be no mercy for slippery oil prices. Even a big draw-down in crude oil inventories has its silver lining for black gold bears: the rise in distillate inventories, and crude keeps cracking.

While USD/CAD is a bit off the highs, it may be ready for a new assault to fresh highs – deeper lows for the Canadian dollar.

WTI crude oil has dipped to a new low of $34.19, the lowest since the worst of the financial crisis. Brent Crude has followed suit with yet another 12 year low, also at the $34 handle. The tensions between Saudi Arabia and Iran don’t have much to do with ancient schisms of Islam but with the worsening situation in the prices of this all important energy source.

It could have been a better day for the Canadian dollar: Canada’s trade deficit came out narrower than expected at 2 billion, and also the previous figure was revised to the upside. In addition, after the recent break, we could have seen some kind of correction. Well, the bottom of the barrel is probably not in sight, not yet.

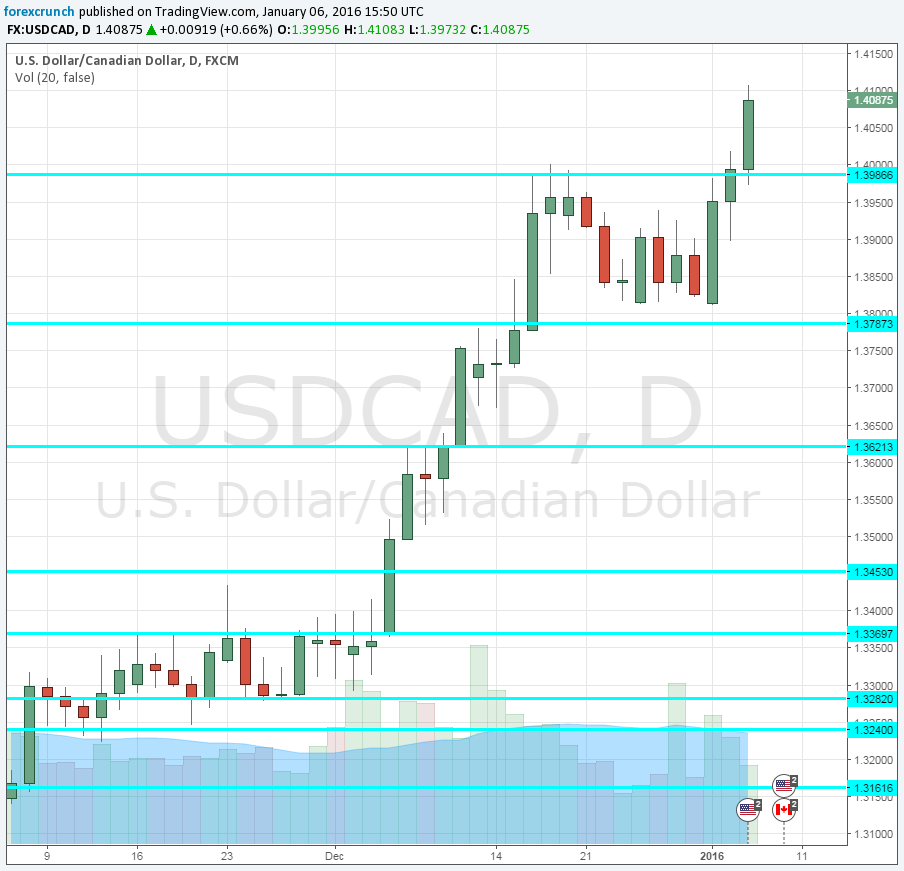

Here is the daily chart of USD/CAD: we already had a peek above 1.41 and fresh highs seem to be a matter of a time, not a long time.