The Canadian dollar managed to stabilize after the big falls, but this may not last too long. However, the pound’s strength could continue, especially against the euro.

Here are the views from CIBC:

Here is their view, courtesy of eFXnews:

The following are the weekly outlooks for the CAD, and GBP as provided by CIBC World Markets.

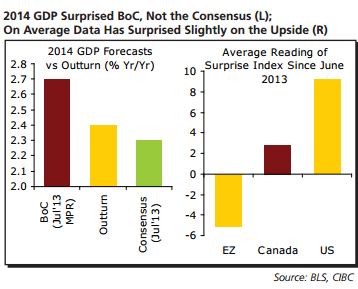

CAD: Poloz: It Wasn’t Me! Analysts think they’ve caught BoC Governer Poloz talking down the loonie. Yet he says “it wasn’t me”. While it’s true that GDP growth in 2014 didn’t live up to what the BoC forecast in his fi rst MPR, it was marginally ahead of consensus expectations from that same period. Meanwhile, through its ups and downs, the economic surprise index has actually averaged slightly above zero since June 2013. While not as positive as the US, that’s far better than the persistent disappointments of the Eurozone.The dovish tone of the BoC weighed on the C$ well before oil tanked, and another 25-bp rate cut in March should help take the loonie towards 77 cents.

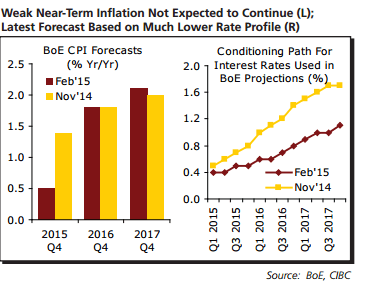

GBP: BoE Clips Dovish Expectations. As necessitated by the continued slump in energy prices, the BoE sharply cut its inflation projections in the near term. However, in an indication that Carney and co. think that markets had moved too far to price out expectations of rate increases, inflation was forecast to be slightly above 2% towards the end of the time horizon.

But don’t bank on a big run-up in sterling as markets re-price expectations of rate hikes. At the time of the last Inflation Report, when the market’s expected interest rate profile was higher, GBPUSD was still only around 1.56″”not too far above its present level. While we agree that BoE rate hikes could come sooner than some may now expect, we prefer to be long sterling against the euro, rather than against the US$.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.