The Canadian dollar did enjoy rising oil prices, but it doesn’t help that much when the source of these rises comes from home, from the Alberta fires. This isn’t the only problem for the Canadian economy:

Here is their view, courtesy of eFXnews:

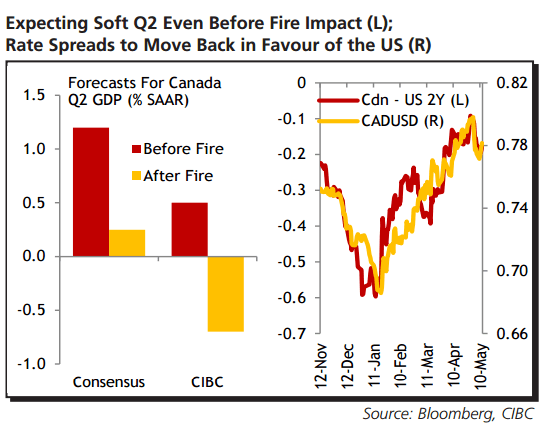

The weak data we think is just around the corner for Canada, rather than an overly pessimistic view of the disruption caused by the Alberta fires, is the reason why we think GDP will disappoint in Q2.

Indeed, the downgrade to our forecast due to the fires (around 1%- pt from Q2) is very close to that of the consensus. Our weaker starting point, though, means we are projecting a modest pull-back in GDP vs the slight growth expected by the street.

We think that first quarter growth was flattered by one-off factors such as the mild weather, and signs of weakness heading into the spring could come as early as next week, when we are anticipating below-consensus readings for manufacturing, wholesale and retail sales.

A turn in the data flow in Canada, and better economic news stateside, would see rate spreads move in favour of the US again and weigh on the C$.

CIBC targets USD/CAD at 1.32 by the end of Q2, and 1.37 by the end of Q3.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.