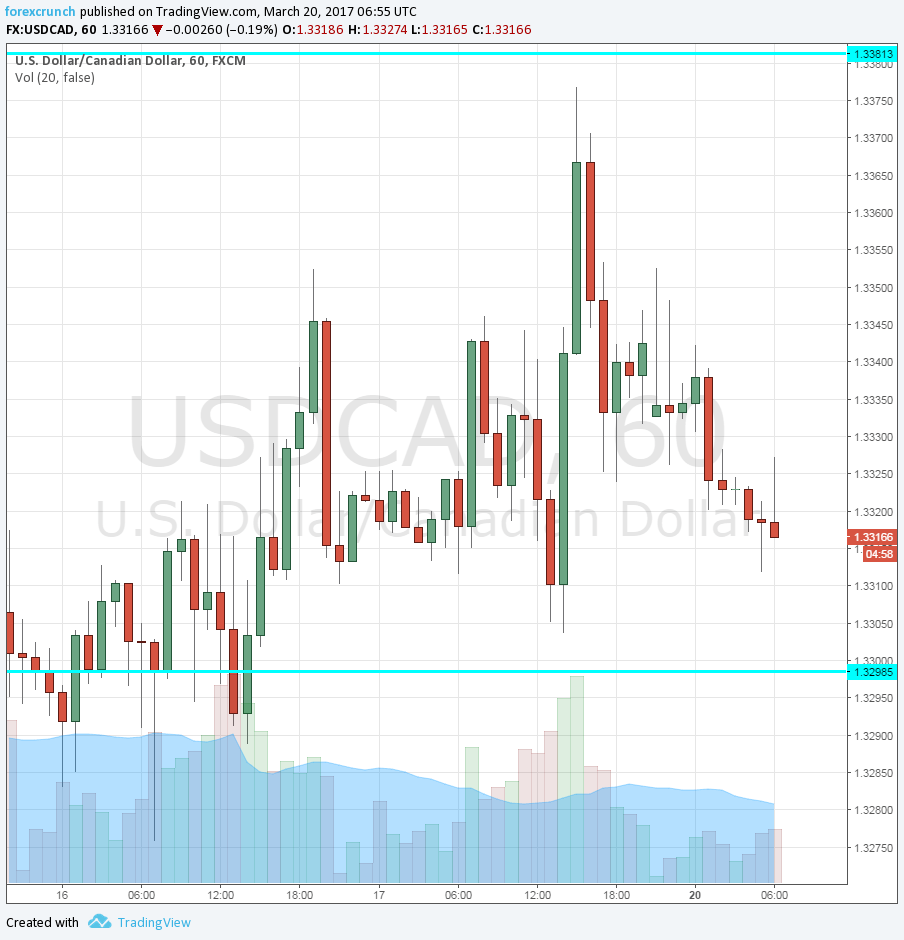

The Canadian dollar made some gains against the greenback, but that is mostly fueled by the weakness of the USD. What’s next for the C$?

Here is their view, courtesy of eFXnews:

The Canadian dollar reversed its course following the Fed’s interest rate decision, seeing its greatest daily appreciation in a year but such gains are likely to fade in the near-term, says CIBC World Markets Research.

“Look for Governor Poloz to retain a dovish tilt in April, especially given that Trump-related risks have yet to be resolved,” CIBC argues.

As such, CIBC argues that a few months the stronger post-Fed loonie will likely look like just a ‘flash in the pan’ on the way to an even weaker exchange rate.

CIBC targets USD/CAD at 1.36 by the end of Q2, and at 1.39 by the end of Q3.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.