The Canadian dollar is on the back foot, sliding alongside the prices of oil. What’s next for the loonie?

The team at CIBC weighs in:

Here is their view, courtesy of eFXnews:

The following is the weekly outlooks for the CAD as provided by CIBC World Markets.

We started off the week lowering our C$ forecast, in large part due to the effects of the tumbling oil price. Recent developments cement the BoC as firmly behind the Fed in the expected timing of first hikes, and though sentiment might paint Poloz as a dove in Canada, he might not be when compared to what’s occurring across the Atlantic.

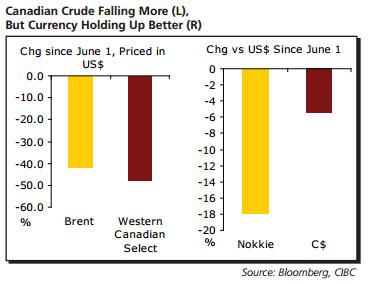

The Norges Bank has recently cut rates due to “softening” activity in the energy sector. Furthermore, the Nokkie has already fallen much further than the loonie, even if the price that Norwegians are selling their oil hasn’t fallen as much as what’s been seen in Canada.

If that’s any guide, look for more C$ weakness ahead.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.