The Canadian dollar is looking for a direction. Here is the view from CIBC:

Here is their view, courtesy of eFXnews:

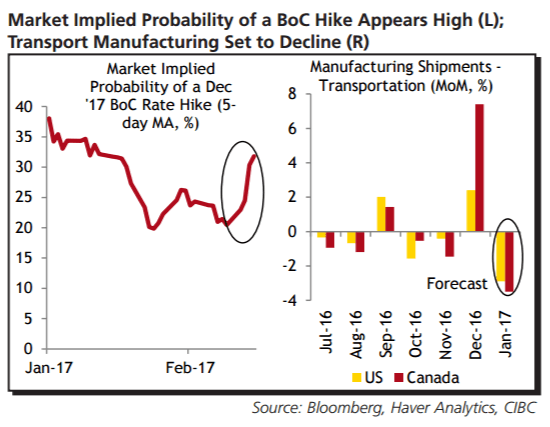

The Canadian economy’s been looking a bit brighter recently. But are markets too optimistic about a BoC rate hike?

Hiring has been strong, but somehow hours worked have actually declined. The trade balance looks healthy in nominal terms, but a glance at volumes paints a drearier picture. And, this week, manufacturing shipments showed a healthy increase, but the gains were by no means broad-based and could be set for a reversal. Early indications suggest that January wasn’t a great month for transportation equipment shipments south of the border, and that’s often a good predictor of trends in that important sector in Canada.

All told, it’s unlikely that the BoC moves this year, and a reduction in pricing should see CAD weaken in the months ahead.

CIBC targets USD/CAD at 1.3400, 1.3600, 1.3900 by the end of Q1, Q2, and Q3 respectively.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.