The Canadian dollar managed to bounce back after oil prices recovered. WTI Crude Oil managed to recapture the $47 triple bottom level it had lost beforehand. In turn, USD/CAD dropped all the way to 1.3650.

The advance of the loonie has now been erased due to an unexpected source. Moody’s, a rating agency, cut the credit ratings of no less than six Canadian banks. These include RBC, the Toronto-Dominion Bank, Bank of Montreal, Bank of Nova Scotia, Canadian Imperial Bank, the National Bank of Canada and the Royal Bank of Canada.

The rating agency sees a more challenging environment that could lead to a deterioration in the asset quality of these banks.

This is not unrelated to worries about Canadian housing. Moody’s says that the move:

Continued growth in Canadian consumer debt and elevated housing prices leaves consumers, and Canadian banks, more vulnerable to downside risks facing the Canadian economy than in the past

USD/CAD rises

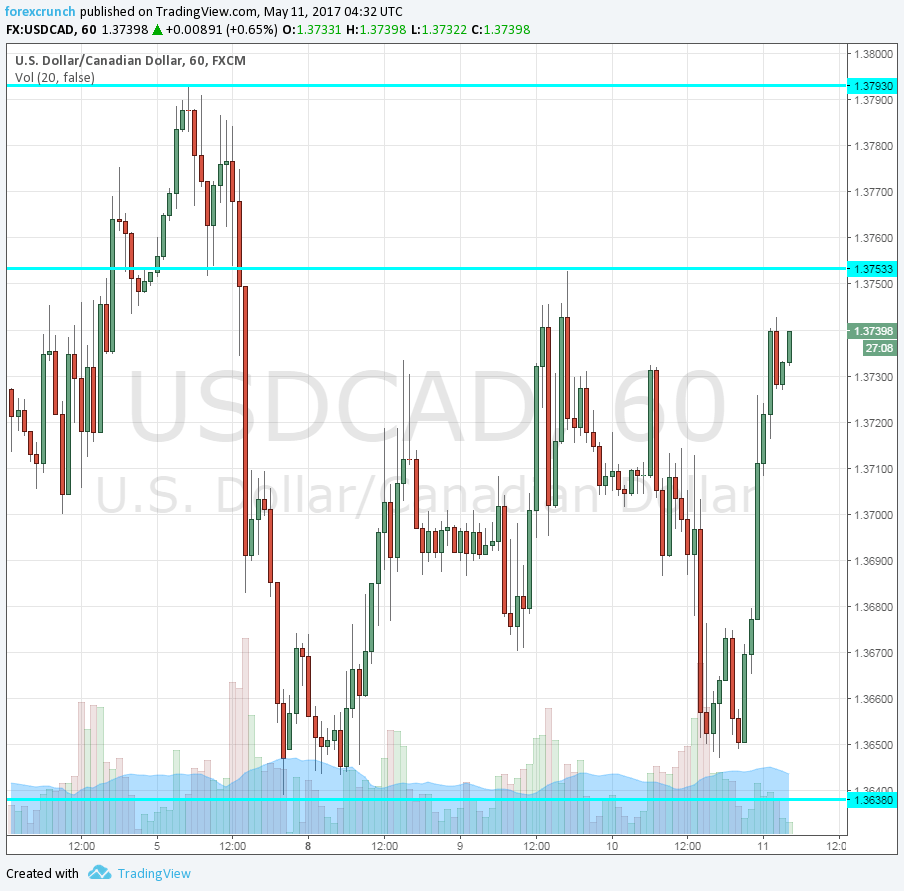

Dollar/CAD is back at the 1.37 handle, trading at 1.3739 at the time of writing. The recent swing high has been 1.3753 and the peak was 1.3790. Support is clear to see at 1.3638, followed by 1.36.

More: CAD: What isThe Signal From Home Capital Group Sage? Barclays

Here is the one-hour chart: