- USD/CAD shot higher on the BOC’s dovishness but the jobs report stabilized it.

- A light calendar leaves the focus on oil and global developments.

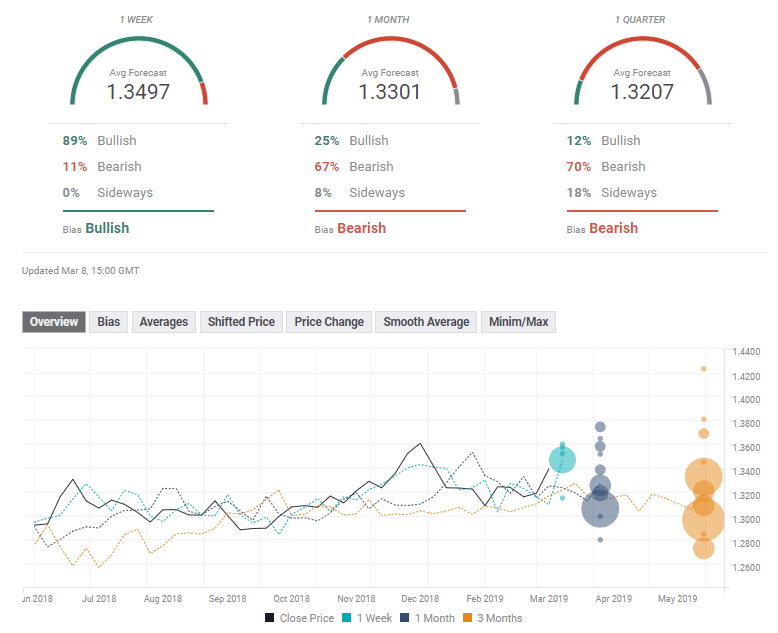

- The technical picture is bullish for USD/CAD while experts are bullish only in the short-term.

This was the week: BOC changes its mind, oil, jobs

The Bank of Canada all but removed its hawkish bias. After having a clear bias in favor of raising rates, the BOC now seems reluctant to make any moves this year. The global slowdown and a weak Canadian economy in Q4 caused the change of heart.

However, not all parts of the economy are looking weak. The labor market surprised once again with Canada gaining no less than 55.9K positions. Moreover, wages continued their recovery by accelerating to 2.25% in February after stabilizing at 1.82% in January. The two consecutive rises come after months of deceleration. And while the unemployment rate remained unchanged at 5.8%, the participation rate leaped to 65.8%. And, the composition of jobs was clearly skewed in favor of full-time positions.

The loonie still ended the week lower also due to the fall in oil prices. A jump in US inventories of crude oil triggered a belated reaction. Correction after the rises is probably another reason for the slide.

In the US, the Non-Farm Payrolls fell short of expectations with an increase of only 20K jobs but wage growth accelerated to 3.4% YoY and the various unemployment rates slipped. The ISM Manufacturing PMI and New Home Sales also beat expectations.

Trade talks between the US and China continue, but a meeting between Presidents Donald Trump and Xi Jinping has yet to be scheduled and this weighs on the mood. In addition, China set low growth targets and the ECB went in the footsteps of the BOC and other central banks, turning dovish. The pressure on stocks was also felt in risk currencies such as the loonie.

Canadian events: Watch the USMCA ratification and Wilkins

A light Canadian calendar means that the emphasis is on other events. The new trade agreement, the USMCA, will finally make its way to the US Congress for ratification. It is unclear if it will pass. The accord was sealed in the autumn of 2018 and relieve Canada of fears. However, it is not over until US lawmakers with different interests have their say.

In addition, the global mood will also make a difference. Apart from the trade talks mentioned earlier, Brexit may have some impact on the loonie. If Parliament approves an extension of Article 50, the C$ may rise on the risk-on mood. It could drop if the UK gets closer to a hard Brexit.

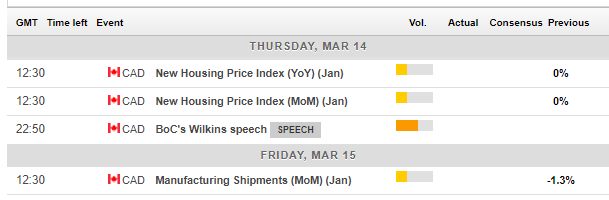

The one event that stands out on the calendar is a speech by BOC Deputy Governor Carolyn Wilkins. She has previously preempted moves by the Ottawa-based institution and this may happen again now.

Here is the Canadian calendar for this week:

US events: Consumer and inflation

The US calendar is quite busy and kicks off with a top-tier event already on Monday. US retail sales are expected to bounce after horrible numbers in December. Markets will eye revisions to the previous data as well as the fresh figures. Note that the data is delayed due to the government shutdown.

The inflation report is due on Tuesday. A minor slide in the top figure is projected: Core CPI carries expectations for a fall from 2.2% to 2.1%. Other data are forecast to remain stable.

PPI on Wednesday and jobless claims on Thursday serve as a warm-up towards the consumer sentiment number on Friday. The University of Michigan’s forward-looking preliminary survey is off the highs near 100 but still at high ground. Expectations are for a virtual repeat of the data seen in February.

All in all, a week packed with top-tier data.

Apart from the economic indicators and global developments already mentioned, the US Dollar could move on political events surrounding the Mueller investigation.

Here are the critical American events from the forex calendar:

USD/CAD Technical Analysis

The Relative Strength Index on the daily chart shows how USD/CAD evaded the 70 level, thus not entering overbought conditions. Momentum is slightly positive and the pair trades above the 50 and 200-day Simple Moving Averages. All in all, the trend is bullish.

1.3420 is still fought upon and may cap USD/CAD. Resistance awaits at 1.3470 which is the fresh peak. Above this level, we are back to numbers last seen at the beginning of the year. 1.3670 provided support in December when the pair traded at higher levels. 1.3670 capped the pair around the same time.

Support awaits at 1.3375 that held Dollar/CAD in January. 1.3340 held it down in mid-February. 1.3240 was a resistance level in late February and 1.3200 was a swing low in February. 1.3110 was the low point late in February and the next support line after that is only at 1.2970.

USD/CAD Sentiment

The global gloom and doom is not a fad and is here to stay. With the BOC turning to the dovish side, the loonie has more room to fall and USD/cAD could extend its gains.

The FXStreet forex poll of experts shows a bullish trend in the short term with a turn to the downside afterward. The targets are descending. And while the short-term goal moved higher, the three-month target dropped considerably.

-636876557477565254.png)