The Canadian dollar managed to ride higher on the Keystone XL news, even if it may be too late. But things could change:

Here is their view, courtesy of eFXnews:

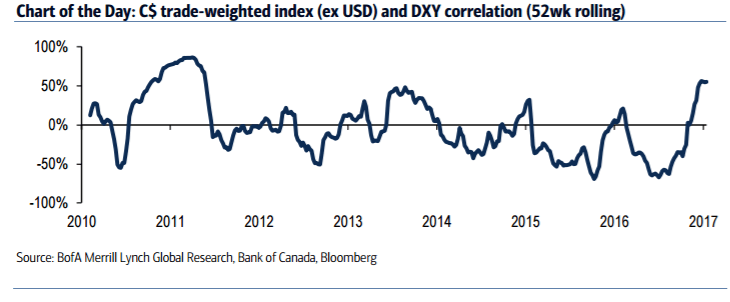

The correlation between the Canadian dollar and USD is at its highest since 2011. The case for divergence is strong.

The Federal Reserve is two hikes into policy normalization while Bank of Canada (BoC) Governor Poloz left open the possibility of a rate cut last week amid a still large output gap and a US-driven tightening of financial conditions. The increased correlation suggests the market believes the next US fiscal stimulus will equally benefit Canada. We would expect some positive spillovers, but other aspects of President Trump’s policies, namely NAFTA renegotiation and a border adjustment (BA) tax suggest underpriced macro risks that will continue to be a headwind for CAD over the course of 2017. Indeed, while the timing is uncertain, we see a BA tax as a strong tailwind for the US dollar.

In contrast, Canada’s high export and import exposure to the US leaves it particularly vulnerable, a factor that could weigh on CAD. As such, it is unlikely the BoC will be following the Fed in hiking rates anytime soon despite market pricing. Lastly, while oil prices are set to rise this year, the CAD-positive impact will likely be mitigated by a pickup in US production as well as a persistent current account financings issues, especially since US yields rise.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.

Bottom line: USD/CAD still has significant upside potential Policy divergence still supportive Despite the increased correlation between the CAD and USD, the case for divergence is clear. Amid a still large output gap, weak inflation pressure, and a US-led tightening of Canadian financial conditions, the BoC is comfortably on hold and may even cut if things get bad enough. Pushing back against a further unwarranted tightening of financial conditions will be a key feature in coming months and will leave them with a dovish bias. Meanwhile, the market is pricing two Fed hikes, but risks remain tilted to the upside if President Trump delivers on his pro-growth promises. Therefore, policy divergence will continue to be a stable upside support for USD/CAD over the course of the year.

BofA Merrill targets USD/CAD at 1.38, 140, 1.41, and 1.43 by the end of Q1, Q2, Q3, and Q4 respectively.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.