A strong currency rises on good data and ignores bad data. A weak currency falls on poor data and ignores good data. The Canadian dollar is showing a very weak hand: falling despite good data from the Canadian housing sector.

Canadian housing starts are up from 213K to 22K, beating expectations for 204K. Building permits jumped by 2.5%, defying expectations for a fall of 1.8%. And to top it off, the advance came on top of an upwards revision.

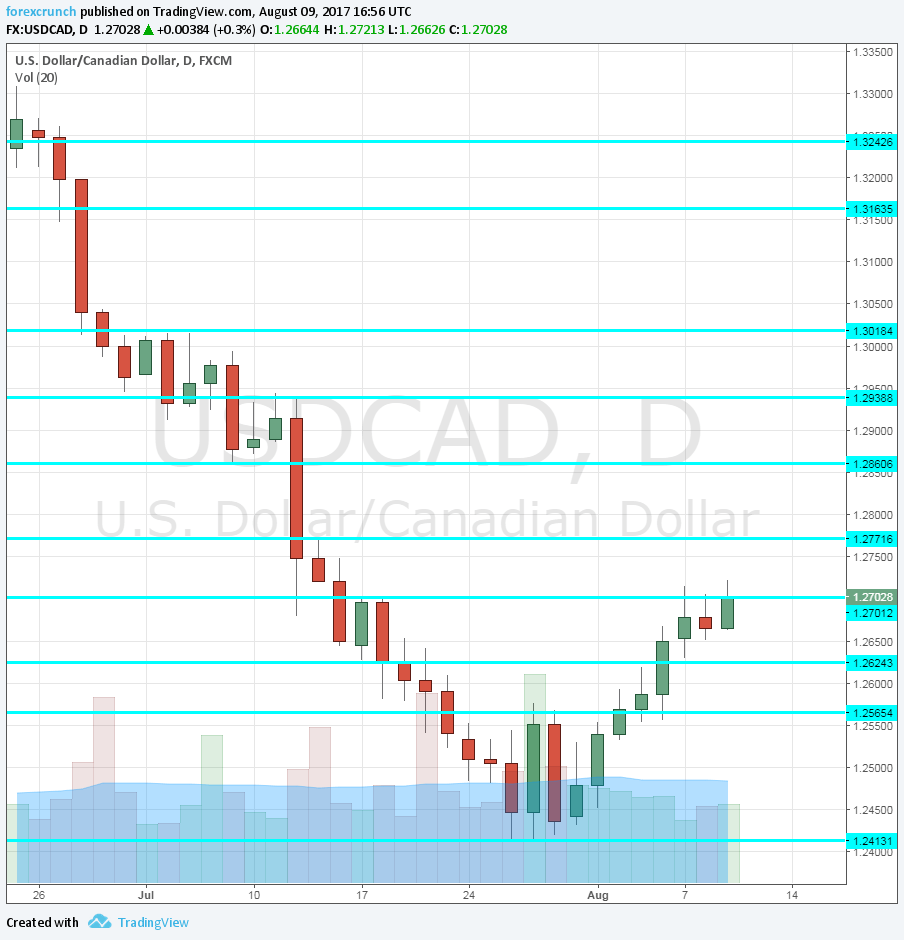

Nevertheless, the C$ extended its retreat. At 1.27, USD/CAD is already some 300 pips of the lows. What’s going on?

- It isn’t oil prices: WTI crude oil is actually up on the day, trading at $49.29. In general, the black gold is around the highs of the range.

- Dollar strength: The greenback made a comeback after the upbeat jobs report and extended some of its gains as a reaction to the JOLTs report. However, the euro stabilized after the fall.

- Geopolitics: The dollar is also weak against the yen and the franc, and this is a reaction to the recent rhetoric around North Korea. Tension mount after Trump threatened the rogue nation. Safe haven currencies are on the up and risk currencies are down.

Nevertheless, the loonie seems to have lost its steam ahead of the US Non-Farm Payrolls report and well before the recent flare up in the Korean peninsula.

When a currency extends its losses despite positive data, it’s clearly weak.

How long will this last? It is hard to tell, but after a huge rally, a significant correction is needed.

More: USD/CAD: BoC To Be Cautious In Letting CAD Appreciate Further; Where To Target? – CIBC