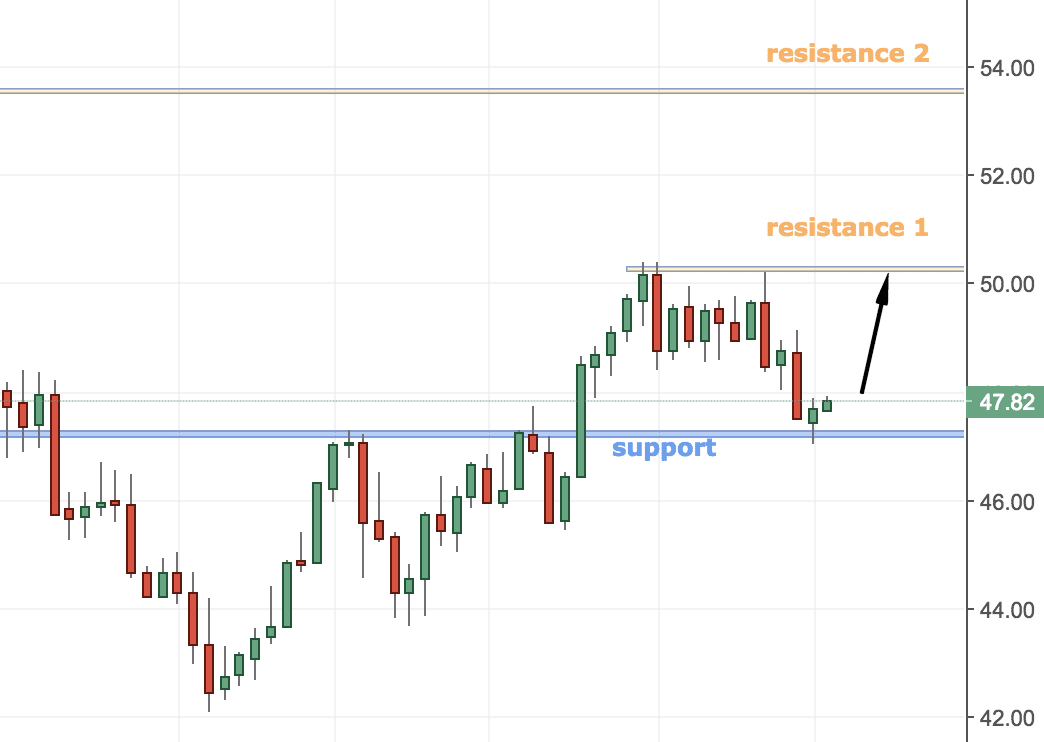

It has been a quiet period for Crude Oil. I have just spotted a possible reversal pattern at the major support level above 47.00. It seems like there is a small rejection candle. The candle formed just above the support level, which gives further reassurance.

One potential scenario that I will be looking at is for the price to bounce off and reach the 50.00 level. If that happens, then I will be looking for two things:

- Rejection of the 50.00 level and further slides to the downside

- Breakout from this level and a potential rise to 54.00.

If the second scenario materializes, this would give us around 12.5% gain. Although quite optimistic, it is a possible scenario and one which could easily turn into a major buying opportunity.

One more last thing- keep an eye for the Crude Oil Inventories at 15:30 GMT, because this could certainly give an initial push to the price.

How Does That Relate to USD/CAD

USDCAD and Oil Relationship:

To this day, over a hundred products can be manufactured from an oil barrel. Keep this number in mind from now on whenever you think of oil’s importance.

Technological advances made oil extraction cheaper and faster. In time, new inventions and discoveries made oil-derived components useful (e.g. petrochemical industry boom is only starting).

That’s especially true in Canada. You see, the Canadian economy is an energy driven one. As such, the oil industry plays an important role in the Canadian GDP.

We all know that the GDP tells the state of an economy: it shows the total value of goods and services an economy produces. Hence, the central bank, Bank of Canada in this case, closely watches the changes and adjusts the monetary policy.

Because of the oil industry employing many Canadian people, the way oil prices fluctuate have a strong influence on the Canadian’s economy. Hence, on the Canadian currency.

USDCAD and Its Outlook:

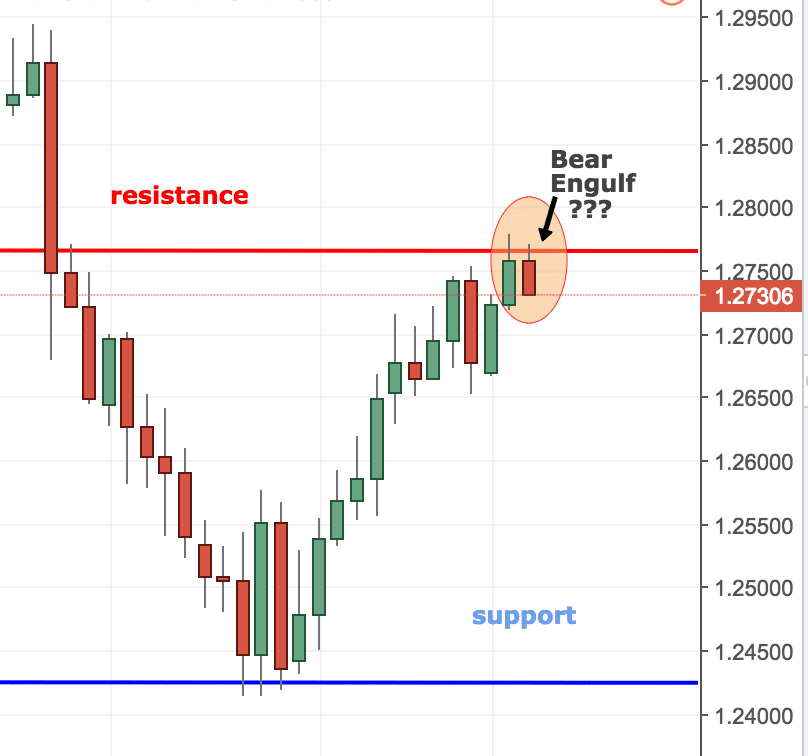

It seems like the USDCAD is just below a major resistance area (red line). It is highly likely that the daily candle will end up being a bearish engulfing. If that is so, then, there is a reason for traders to short this pair. Together with Crude oil, this could be the beginning of a change of direction.

A possible scenario for USDCAD would be:

- A) The daily candle closes as a bearish engulfing- this would give a good reason to short the pair

- The daily candle rejects the lows, therefore no bearish engulfing candle form on the daily chart. The uptrend is more likely to continue.

One way or another, time will show us which way the price will go. As a keen follower of price action, I tend to read the market and not predict it. So, let’s see what the market holds for us.

Guest post by www.colibritrader.com