The US dollar has performed badly in the recent days, and that is the reason why not only currencies, but also commodities got a boost. Yesterday, there were a few economic releases, which came as a disappointment. Today, there is an important event i.e. the FOMC meeting minutes which might cause a lot of volatility during the NY session. Any dovish remarks might push the US dollar further lower and on the other hand optimism will boost it. In the first case GOLD is likely to trade higher and in the second case it might melt down again. Let us look at the technical levels and analyse the charts.

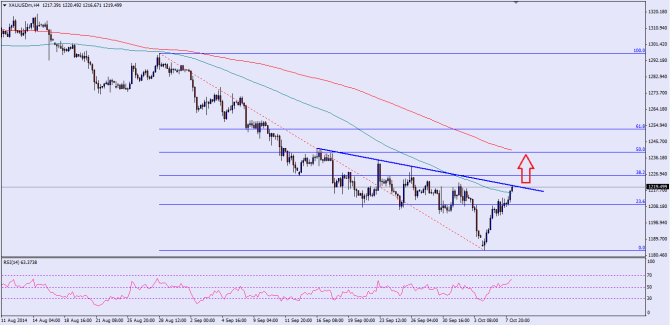

There is a critical trend line formed on the 4 hour chart of GOLD, which is acting as a resistance currently. It has managed to clear the 100 SMA, which is a bullish sign as of now. If it manages to clear the mentioned trend line, then it will open the doors for a run towards the 200 simple moving average. The most important point is that the 200 SMA is also coinciding with the 50% fib retracement level of the last drop from the $1296 high to $1183 low. So, GOLD sellers might take a stand around the stated resistance zone. A break above the same could lift the mood of buyers for a move towards the last high.

On the downside, the broken 100 SMA could act as a support for GOLD, but a close above the same is still not convincing. We need to see if GOLD dips, then how it reacts around the $1210-05 levels.

Overall, one might consider buying with a break of the trend line as long as it stays above 100 SMA.

————————————-

Posted By Simon Ji of IKOFX