Canada released a bulk of retail sales and inflation data. The data is mixed, but the weaker parts seem to take over. Core CPI is up only 1.1% y/y, a drop from 1.3% last month and 1.4% expected. Headline inflation also fell short by remaining at 1.6%.

Retail sales look better: a rise of 0.7% against 0.4% projected and on top of an upward revision. However, core sales printed a significant shortcoming by dropping 0.2% instead of a rise of the same scale.

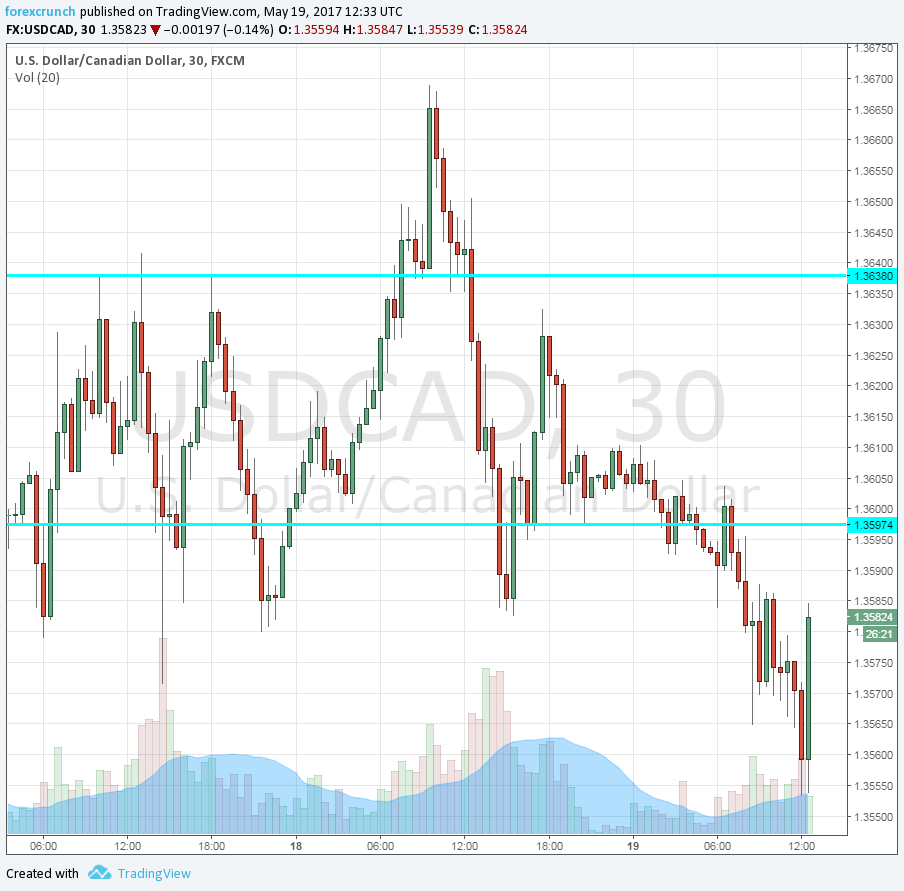

So, USD/CAD bounces from the 1.3553 bottom and trades at 1.3583, a rise of some 30 pips.

More: CAD: Has Peak Negative CAD Sentiment Been Reached? What’s The Trade? – Nomura

Here is how the bounce looks on the 30-minute chart:

USD/CAD was tumbling down ahead of the publication. This is a result of various factors. Oil prices are on the rise once again, with WTI hitting $50. The trigger was talk about a “deeper and longer deal” between OPEC members and also with their non-OPEC counterparts.

The second reason for the drop in USD/CAD stems from the weakness of the US dollar. The feared crippling of the Trump administration following the recent scandals weighs on the greenback.

All in all, USD/CAD was lower until the data came along.