- The USD/CAD had a relatively stable week amid mixed USD moves and upbeat Canadian GDP.

- The Canadian jobs report and US inflation are the biggest market movers.

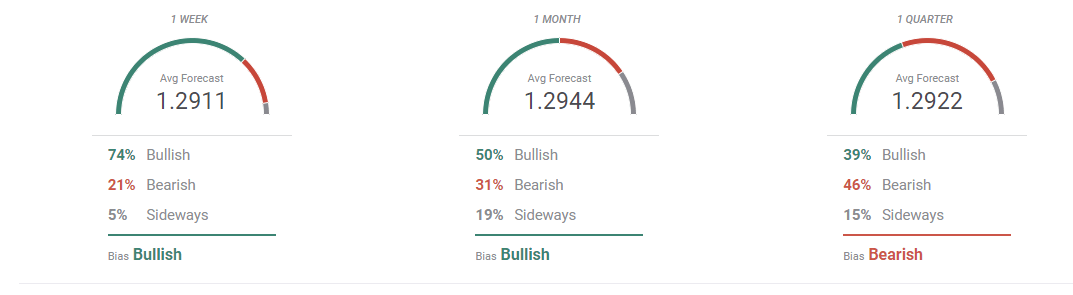

- The technical picture for the USD/CAD is balanced.

Mixed USD moves, still no NAFTA

Canada enjoyed a monthly growth rate of 0.4%, better than had been expected. This is a significant relief after a dip of 0.1% in January and slow growth in Q4 2017. The forward-looking Ivey PMI jumped to 71.5 points in April, indicating very robust growth in the economy and a considerable leap from 59.8 points in March. Markit’s Manufacturing PMI came out at 55.5 points, in line with expectations.

Bank of Canada Stephen Poloz made another public appearance but did not add any insights after his previous speeches in recent weeks. The Bank of Canada is now seen as potentially raising rates in July, but markets undoubtedly have their doubts.

Negotiations around NAFTA continued but not enough progress was made. As the campaign for Mexico’s elections is already underway, the clock is ticking, and what seemed like an almost done deal is now in retreat. A breakup of the talks for a long break is now on the cards. Efforts continue in Washington.

In the US, the Federal Reserve left the interest rates unchanged as expected. The message on inflation was mixed: while they are happy with higher inflation, Powell and co. now point to a symmetric goal. This was interpreted as tolerance to higher inflation levels and therefore no rush to raise interest rates. The commentary on the economy was cautious.

The Non-Farm Payrolls disappointed with a gain of 164,000 against 103,000 expected. Wages rose by only 0.1% MoM and 2.6% YoY, also falling short. However, the US Dollar recovered quite quickly after the initial drop. The Fed is still likely to raise interest rates in June.

Bond yields remained at high levels but did not go too far. The 10-year Treasury bonds fell below the 3% mark they struggled to conquer.

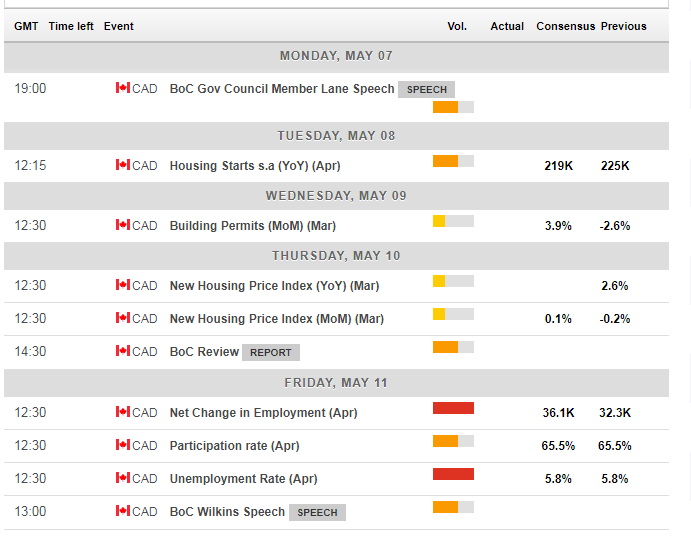

Canadian events: Jobs report stands out

The week begins with a speech by Bank of Canada member Timothy Lane. He may take the opportunity to respond to the upbeat GDP figure and perhaps to the risks of trade. The focus then shifts to housing data. Housing Starts are expected to tick down in a report published on Tuesday while Building Permits on Wednesday are predicted to bounce back with 3.9% in March after a fall of 2.6% in February. The New Housing Price Index will complete the picture on Thursday.

The housing sector is getting more attention after some wobbles in Toronto’s market, following significant changes in regulation. The Bank of Canada recently emphasized the importance of macroprudential measures. For the Canadian dollar, weakness in the housing market could result in a drop in the loonie. Additional macroprudential measures to cool down the sector are also harmful: they serve as a substitute for interest rate hikes. A stable or growing construction sector would be C$-positive.

The BOC review published on Thursday is also worth noting. The report does not usually stir markets like the BOC Business Survey, but this time may be different. The Canadian economy slowed down at the end of 2017 and in early 2018. However, the recent GDP report came out above expectations. Is growth accelerating once again? The publication from the central bank may provide more information.

And, the primary event of the week comes out on Friday: the jobs report for April. Canada is expected to publish another substantial gain in jobs: 36,100 against 32,300 in March. The unemployment is projected to remain unchanged. After a few unusual months that saw significant changes, the past two reports have been more stable, and the last one was already strong and durable. A confirmation of expectations can send the loonie higher.

Bank of Canada Senior Deputy Governor Carolyn Wilkins will speak just 30 minutes after the labor data is out. In the past, speeches by Wilkins moved markets, and in her statement in Toronto, she may respond to the fresh data. However, the topic of her discourse is “Closing the Gap: How an Inclusive Economy is a More Secure One” so she may also skip talking about monetary policy.

Here are the upcoming events that will move the Canadian dollar as they appear on the forex calendar:

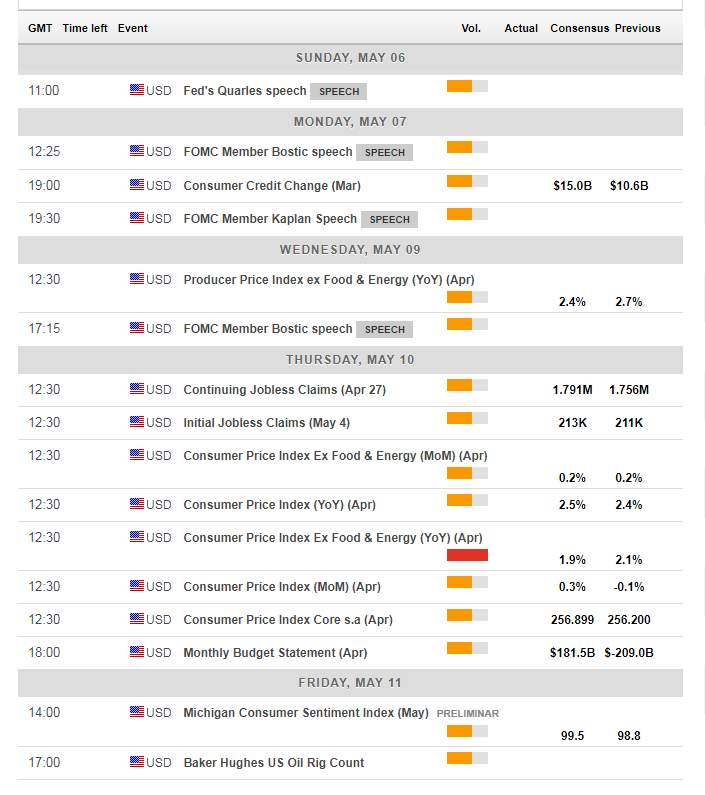

US events: Inflation in the limelight

After the Non-Farm Payrolls and the Fed decision, the first full week of May is somewhat lighter. FOMC members dominate the beginning of the week. Quarles is likely to focus on regulation, Bostic is a dove and Kaplan has moved from being a light dove to being more optimistic. If Bostic is more confident, it could be USD positive while a concerned speech by Kaplan, especially on trade, could hurt the greenback.

Wednesday sees the publication of the Producer Price Index which serves as a warm-up tot he CPI data. The main dish is on Thursday with the Consumer Price Index. After a jump to 2.1% YoY, the all-important Core CPI is now expected to tick back down to 1.9% in April. Headline inflation carries expectations for a rise from 2.4% to 2.5%, fueled by gas prices.

Last but not least, the Consumer Sentiment measure from the University of Michigan is projected to rise from 98.8 to 99.5, indicating more robust consumer spending.

Here are the critical American events from the economic calendar

USD/CAD Technical Analysis – Bulls are still OK

The RSI has stabilized above 50, pointing to further gains, Momentum is positive, and the pair continues trading above the 200-day Simple Moving Average. However, the pair is not going anywhere fast, staying around the $1.2860 level. This could indicate a preparation for a change of direction. The USD/CAD has already experienced quite a few turnarounds in 2018.

Looking up, 1.2915 was a stubborn cap in late April and early May. The round number of 1.3000 is next in line. Apart from serving as a psychological deterrent, the pair stalled at this level in early March. Higher, 1.3050 supported the pair when it traded on higher ground while 1.3126 was the cyclical peak on March 17th.

On the downside, 1.2800 supported the pair in late April and early May. Further down, 1.2760 was a swing high in early March. The next lines to watch are 1.2690, 1.2640 and 1.2530.

Where next for USD/CAD?

Momentum is waning. This does not seem like a consolidation. The Canadian economy is showing more positive signs. While the Fed is still on course to raise rates, some of the wind is gone. A lot depends on the Iran deal and the reaction in oil prices.

The FXStreet Forecast Poll shows a bullish tendency in the upcoming week, contrary to the sentiment expressed here. Later on, the sentiment is more mixed.

More: BoC Poloz: hopeful as ever, but still playing on the safe side

-636610416942114650.png)