2017 has begun in full thrust: the holidays are fully over with North American and British traders getting back to their desks. In the dawning days of the new year, we seem to get a resumption of the trend seen in 2016: a stronger US dollar.

And once again, the rise of the US dollar lacks the inverse correlation with oil prices. The greenback rises on hopes for fiscal stimulus from the Trump administration, leading to higher inflation and higher rates.

Oil prices are extending their gains as OPEC begins implementing the accord reached late in November. Kuwait and Oman begin delivering oil cuts as the agreement comes into effect.

WTI Crude oil trades at $54.91, above the high of $54.50 seen immediately after the deal, when markets still hesitated regarding the implementation. There are still reasons to be doubtful, given the patchy past of previous announcements. The high so far has been $55.21.

What does this mean for USD/CAD?

Oil prices support the Canadian dollar against other currencies, including the USD. However, the USD is on the rise.

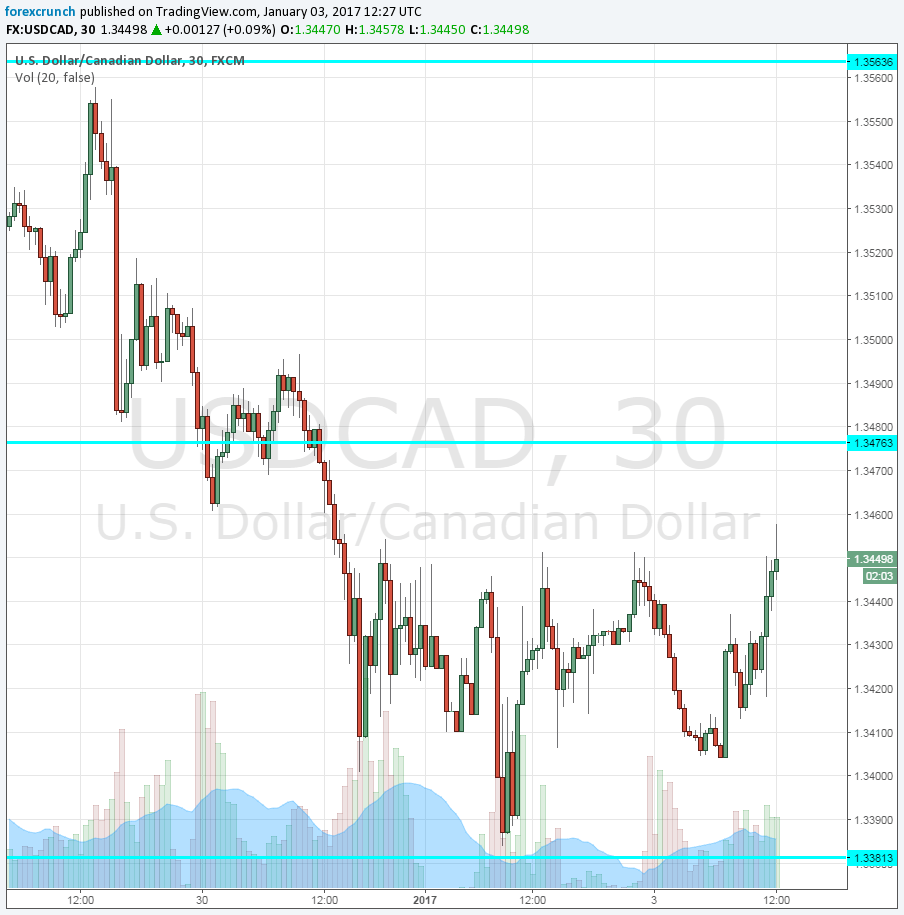

So far, the winner is the US dollar and the loser is the Canadian one. USD/CAD is on the rise once again, trading above 1.3450. The next

The next level of resistance is quite close by, at 1.3460, a support level seen late in 2016. It is followed by the round number of 1.35. Further above, 1.3560 serves as a cap. Support awaits at the recent low of 1.3380.

More: USD/CAD: Stay Long Targeting 1.3650 – TD