The Canadian economy grew by 0.6% in the wake of 2016, double the early expectations for January. year over year, this is a rise of 1.5% instead of 1.1% expected At the same time, US jobless claims missed with 276K.

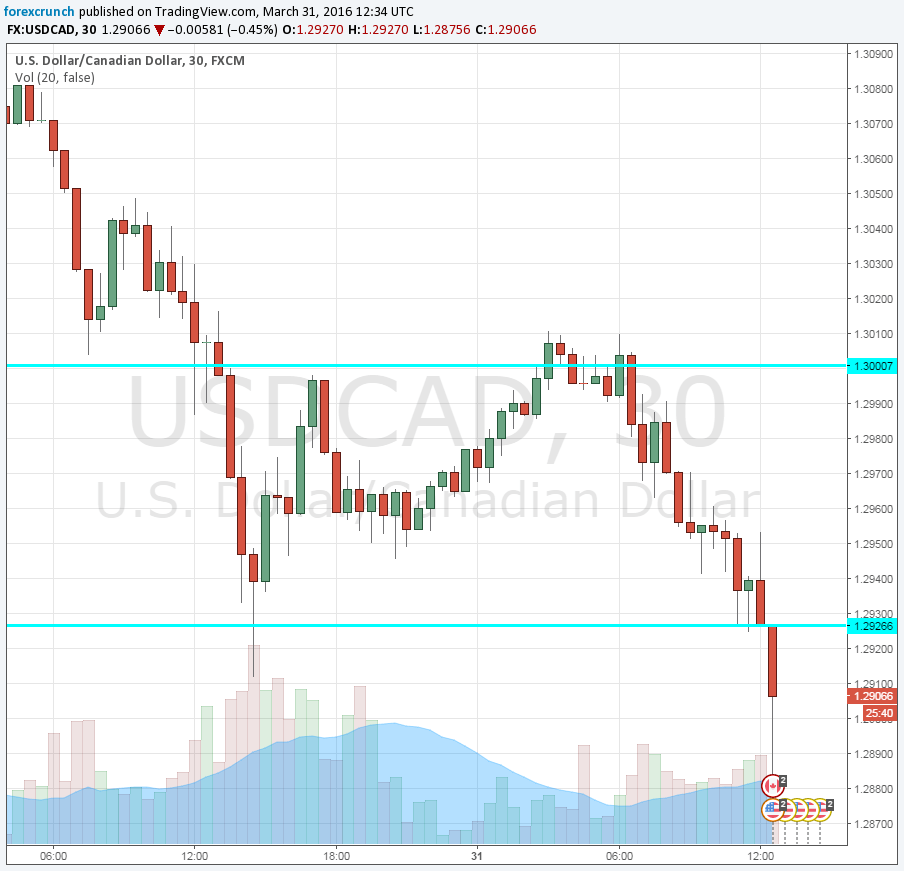

USD-CAD slides under support at 1.2930 and reaches down for a new a new low at 1.2875 before bouncing.

While most of the growth came from goods, there were also rises in oil and gas, which is quite surprising given the tough times for this industry.

Canada was expected (see the how to preview) to report a monthly growth rate of 0.3% in January 2016 after +0.2% in December. The country is unique in reporting GDP on a monthly basis.

USD/CAD was reaching for the lows, trading around 1.2945, just above support at 1.2930 towards the release.

The Canadian dollar enjoyed the better than expected crude oil inventories report, which showed a small gain in crude and better outcomes in gasoline and distillate inventories. While this only temporarily boosted the price of oil (which fell since), the C$ showed a lot of resilience with USD/CAD remaining under 1.30.

The big push down for the pair came from the yet another dovish appearance by Yellen. The Chair of the US Fed expressed worries about the global economy, uncertainty about inflation and an “especially” warranted caution regarding rates. With no imminent rate hikes in the US, the US dollar tumbled down.

At the same time of the Canadian GDP release, the US also had its own publication: the weekly jobless claims report, which carried expectations of remaining at 265K.