Despite the Greek approval of the austerity proposals, it is not 100% that we will get a deal.

In any scenario, the team at Goldman Sachs explains why there is a strong case on the downside for EUR/USD:

Here is their view, courtesy of eFXnews:

The uncertainty around the negotiations between Greece and its creditors means the market has low visibility, unable to trade beyond the immediate headlines, notes Goldman Sachs.

“In this situation, the market seems persistently to err on the side of optimism, discounting negative developments to focus on the prospects for a positive resolution. This has been reflected in the modest reaction in peripheral spreads, equities and the EUR,” GS adds.

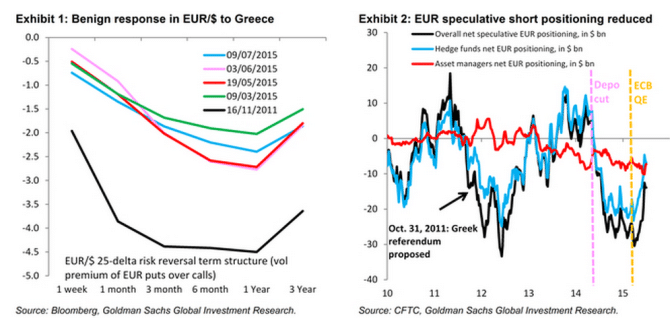

“After all, EUR/$ reflects the market’s expected range of outcomes and the probabilities it assigns to these. Our read is that the market continues to expect a last-minute deal, a view that is understandable given that this has been the outcome in every previous confrontation over Greece. Most simply, this should be apparent from the bounce in EUR/$ on this week’s headlines that some kind of accommodation could be found by the weekend,” GS notes.

“In short, even as ‘Grexit’ risk mounts and is arguably more elevated than ever before, the market does not believe it. We continue to see further escalation as a catalyst for EUR/$ to move near parity, given that ECB QE, which buffers European stock and bond markets, means that EUR/$ downside is the only reasonable hedge for investors, unlike back in 2011/12,” GS argues.

“Our broad G10 FX views remain unchanged. We expect further Dollar appreciation against most of the G10, driven by rising US rates and reflecting the outperformance of US fundamentals. We forecast USD strength to be most pronounced against the EUR, JPY and the commodity currencies. Beyond the USD, we expect the GBP to be stronger vs the EUR and commodity currencies,” GS projects.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.