These are the main highlights of the CFTC Positioning Report for the week ended on April 6th:

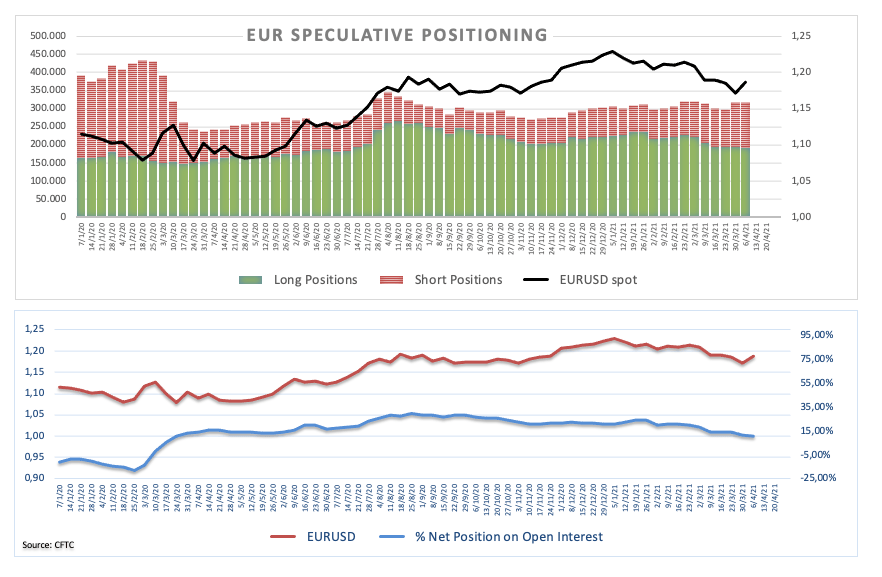

- Speculators kept trimming their gross longs in EUR for yet another week, taking the net longs to the lowest level since late March 2020, the onset of the pandemic. However, fresh speculations on the strong recovery in the Old Continent coupled with a better pace of the vaccination campaign prompted investors to re-shift their focus to the European currency, motivating EUR/USD to strongly bounce off yearly lows in the 1.1700 neighbourhood and retake levels beyond 1.1800 the figure.

- Net longs in USD receded to yearly lows pari passu with the advance of the US Dollar Index (DXY) to new YTD peaks near 93.50. The greenback lost upside traction post-2021 tops, as investors seem to have already priced in the performance of the US economy in the next months as well as the solid developments from the vaccine rollout and extra fiscal stimulus.

- Specs reduced their net longs in GBP to levels last seen in early February. Cable managed to retest the 1.3900 area albeit bulls failed to push further up, opening the door to some consolidation instead. A steady BoE, firm vaccine rollout and the better-than-expected fundamentals as of late lent wings to the sterling, although the theme appears exhausted among investors. Political uncertainty in the months to come plus the still far-from-solved Brexit issue are expected to keep the clouds coming for the quid for the foreseeable future.

- The recent advance in US yields kept both safe havens JPY and CHF on the defensive. Net longs in the Swiss franc dropped to 2-week lows, while net shorts in the Japanese yen eased a tad to 2-week lows.

- Net longs in Crude Oil shrunk to the lowest level since late February after traders assessed the latest decision by the OPEC+ to increase production and lockdown measures remained on the rise in Europe, with the consequent impact on the demand for the commodity.