These are the main highlights of the CFTC Positioning Report for the week ended on July 21st:

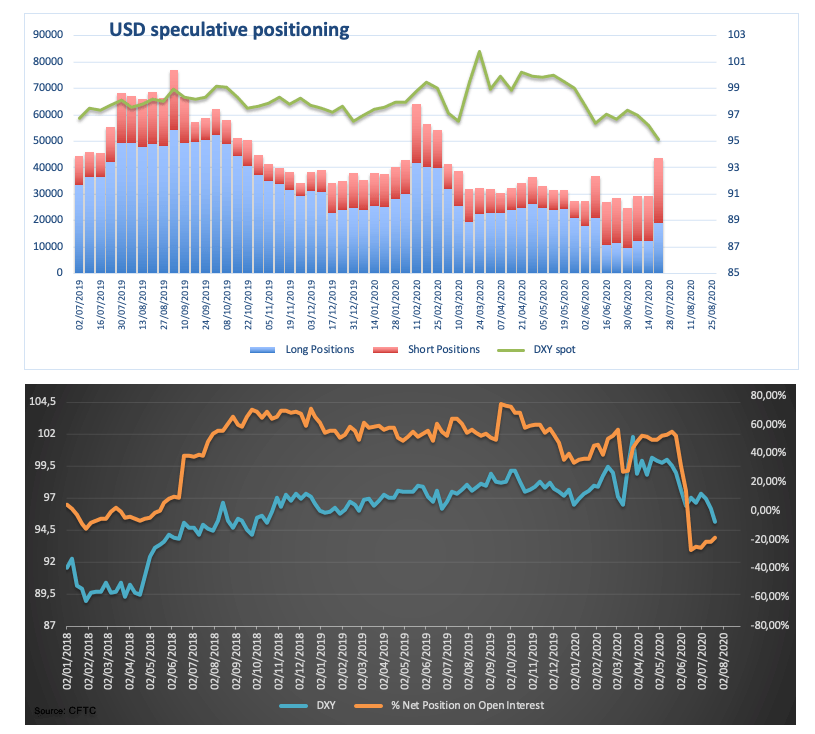

- Speculators kept adding gross shorts to their dollar positions, taking the net shorts to levels last seen in late November 2017 around 5.8K contracts. The greenback eased further ground during last week against the usual backdrop of the broad-based preference for riskier assets, always in response to rising hopes of a strong economic recovery. Against this, the US Dollar Index (DXY) droppede to fresh multi-month lows, but the sentiment and the trend leave the door open for a deeper pullback in the short-term horizon.

- EUR net longs climbed to more than 2-year highs sustained by the generalized risk-on sentiment and positive results from fundamentals in the euro bloc, while the agreement on the European Recovery Fund added to the upbeat mood in the currency.

- Speaking about safe havens, both the Japanese yen and the Swiss franc saw their net longs increased to 3-week highs and to the highest level since early June, respectively. The move appears to show the shift among traders to these currencies in detriment of the dollar.