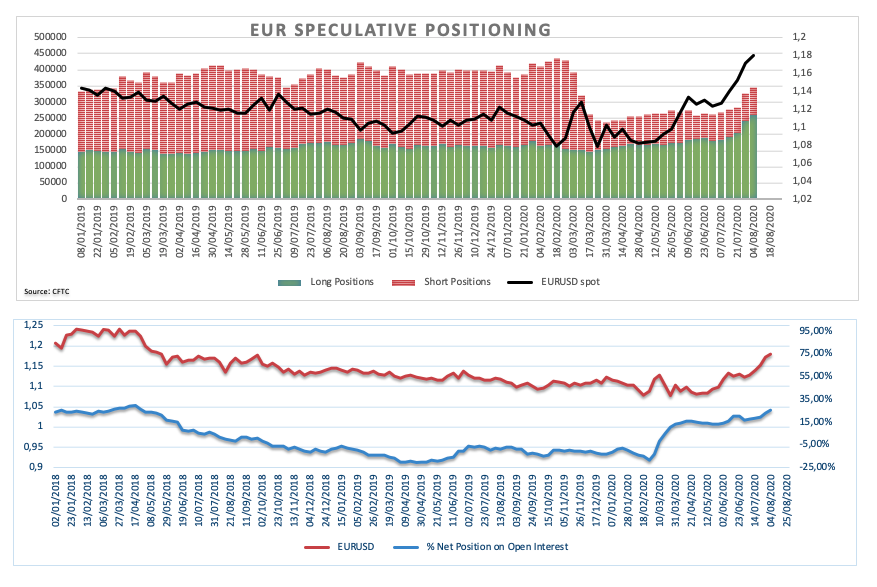

These are the main highlights of the CFTC Positioning Report for the week ended on August 4:

- The speculative community kept the positive stance around the European currency well and sound for yet another week, taking the net longs to the highest level since late December 2011. In fact, positive results from the domestic docket fuelled once again the likelihood of a ‘V’-shaped recovery in the region, while the recently clinched deal around the European Recovery Fund also underpins the solid tone in EUR.

- Net shorts in the British pound rose to 3-week highs on the back of the generalized rally in the risk complex. However, the prospects of extra gains in the sterling are expected to lose momentum in the near/medium-term, where stagnant EU-UK talks, potential extra easing from the BoE, Brexit jitters and the impact of the pandemic on the economy are all forecasted to keep weighing on the quid for the months to come.

- Regarding USD, net shorts eased a tad, probably in light of the extreme oversold conditions of the currency, which sponsored some gain in momentum towards the end of last week. Political effervescence, the unabated pandemic and the massive monetary stimulus running in the economy should all keep the pressure on the buck well in place. Still in the safe haven universe, outflows from the dollar appear to have benefited JPY and CHF, which net longs increased to the highest level since early June and early May 2014, respectively.