These are the main highlights of the CFTC Positioning Report for the week ended on September 8th:

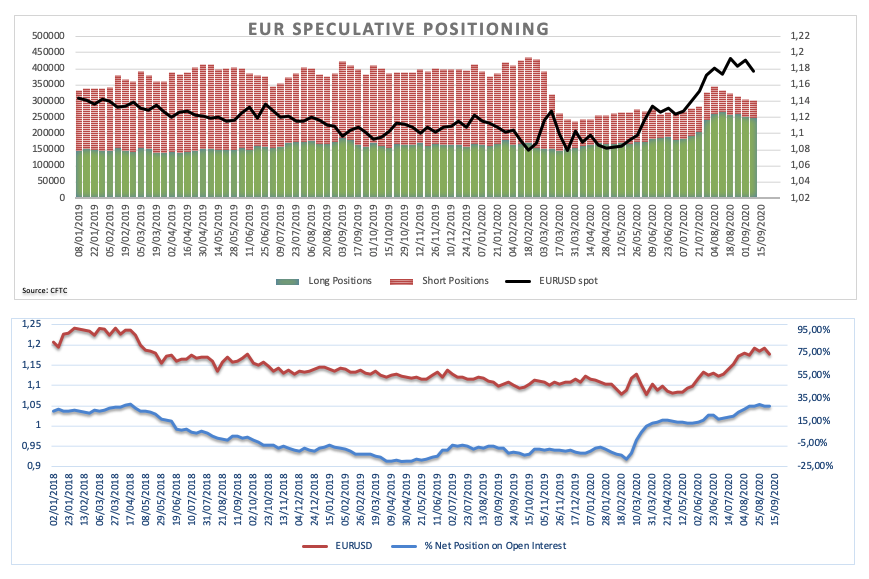

- Traders reduced both gross long and short positions in the single currency and pushed the net longs to a new 2-week highs around 196.8K contracts. This slight improvement reflected the rising cautiousness ahead of the ECB event. However, and in light of the ultimate less-dovish-than-expected message from the central bank, the speculators’ positioning regarding the European currency is expected to have changed in the subsequent week.

- On the other hand, speculative net shorts in the dollar went down to levels last seen in mid-July around 5.7K contracts, as markets saw a pick-up in the sentiment towards the safe havens. Adding to this view, market participants appear to have fully digested the effects of Powell’s speech at Jackson Hole.

- Still in the safe haven universe, speculators kept favouring the greenback in detriment of JPY and CHF, reducing their net longs to 3-week low and 6-week low, respectively.

- Demand concerns on the back of rising coronavirus cases across the word have been impacting on the oil industry, taking net longs on the commodity to the lowest level since late March.