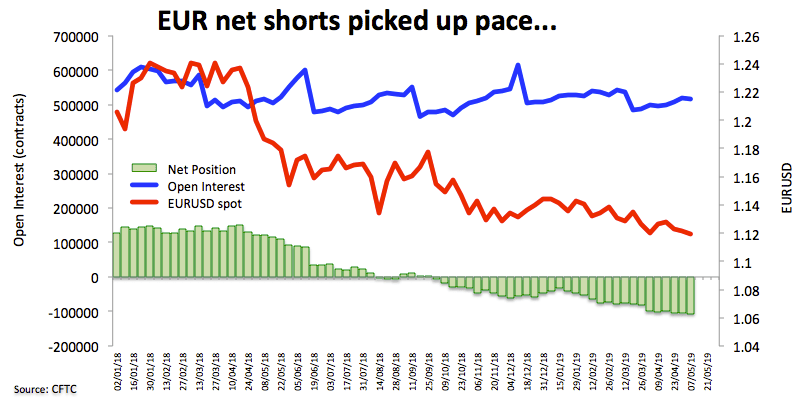

These are the main highlights of the recently published CFTC report for the week ended on May 7.

- EUR speculative net shorts climbed to the highest level since early December 2016 on the back of persistent concerns among investors over the health of the economy in the euro area despite some recent upbeat results from Germany. In addition, trade jitters and Brexit uncertainty are poised to keep weighing on the shared currency.

- USD net longs receded to multi-week lows echoing dovish comments from Fed officials, increased volatility around US-China trade dispute and concerns over the lack of traction in US inflation.

- JPY net shorts retreated to 3-week lows, as the demand for the safe haven currency has been on the rise following increasing effervescence in the US-China trade front.

- Of note is the persistent up move in RUB net longs, navigating record highs beyond 36K contracts and bolstered by positive prospects of the Russian economy and rising appetite for domestic assets.