These are the main highlights from the CFTC Positioning Report for the week ended on February 25th:

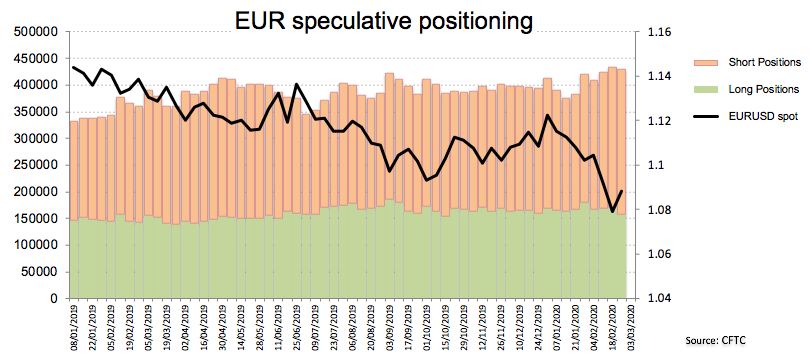

- Speculators kept adding shorts to their already negative position on EUR, taking the net shorts to the highest level since early December 2016. Poor results from the euro area vs. steady fundamentals in the US economy played against the single currency for yet another week.

- USD net longs climbed to the highest level since November 11th 2019 on the back of positive results from the domestic docket and alternating risk appetite trends from the coronavirus developments.

- Gross longs in VIX (aka “the panic index”) rose for the third week in a row, while gross shorts decreased markedly during last week, all dragging the net shorts to the lowest level since early September 2019. Once again, alternating headlines around the Chinese COVID-19 drove the mood among traders and echoed on the index.