These are the main highlights of the latest CFTC report for the week ended on April 16.

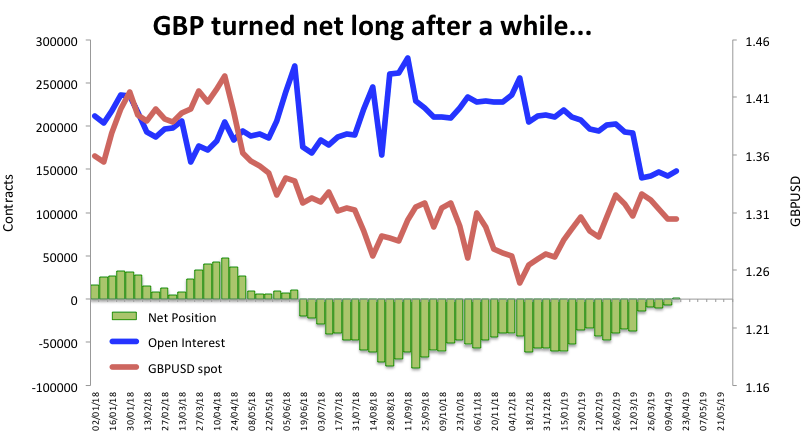

- Speculators turned net longs on Sterling for the first time since June 2018, as hopes of a Brexit deal appear to have re-emerged following the recently announced delay in Article 50 to October 31.

- In addition, investors trimmed their EUR net shorts to new 3-week lows, coincident with the better tone in the risk-associated complex in past weeks, which in turned lifted EUR/USD to tops beyond 1.1300 the figure.

- Further data saw speculative net shorts in the safe haven JPY climbing to the highest level since the end of last year, always in tandem with the pick up in sentiment surrounding the riskier assets.

- Of note was that VIX (aka ‘the panic index’) net shorts rose to the highest level since early October 2017, coincident with the persistent downtrend seen since December peaks.