These are the main highlights of the latest CFTC positioning report for the week ended on October 2.

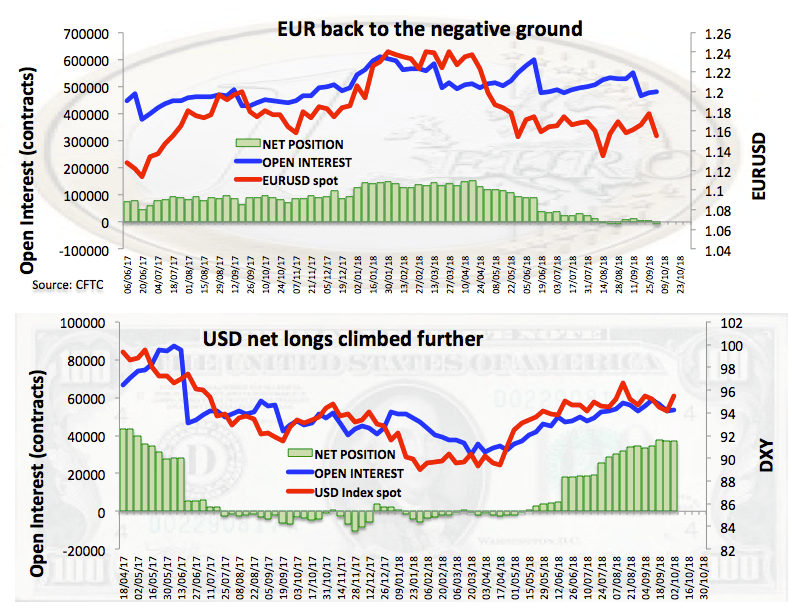

- EUR speculators are back to the net short territory for the first time since late August, all against the backdrop of rising concerns on the Italian fiscal front.

- USD net longs remained in control and climbed to 2-week peaks as investors continued to factor in the prospect of a fourth rate hike by the Federal Reserve by year-end.

- GBP net shorts eased to the lowest level since early August. Despite some progress has been made as of late, the uncertainty over Brexit negotiations appears unabated and is poised keep driving the mood around the Sterling.

- Investors kept adding contracts to their JPY shorts, taking the net position to the highest level since mid-February following a better tone in the risk-associated assets and rising US yields.