- Chainlink price sluggish as the market consolidates.

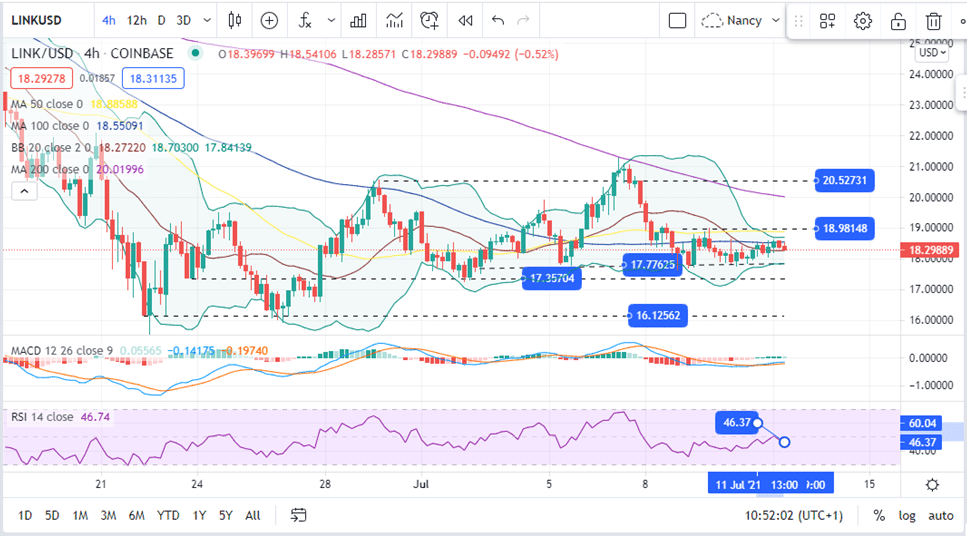

- LINK price squeezes on the Bollinger Bands to remain stuck between the 100-day SMA and $17.77 range.

- MACD confirms the market indecision with the possibility of a bullish breakout.

Chainlink price opened the day in the green as most cryptocurrencies on major crypto brokers struggled to stay afloat. LINK rose 1.54% against the dollar in the last 24 hours, with bulls determined to maintain the upward trend after a significant blood bath that started on July 7. This was after exploring levels beyond $21 and held support slightly above $17. At the time of writing Chainlink was trading in the green at $18.33.

Chainlink Price Stuck Between the 100-SMA and $17.77

Chainlink price is still dragging and way below its all-time high (ATH) price of about $53 that was reached on May 10. LINK price has been trading in a lacklustre over the last week as it wobbles between highs around the 100-SMA and a support at $17.77.This points to a sideways price action as the market consolidates. This outlook is likely to continue in the near term.

The Chainlink price consolidation validates by the four-hour Bollinger Band (BB). LINK is currently exchanging hands near the BB’s midline, which means that the underlying and overhead pressure appear to be equal.

Note that a breakout is likely to occur if the bands continue to squeeze. If this takes place, LINK price is likely to continue sliding and the asset will be forced to retest the support at $17.35.

Chainlink Price (LINK/USD) Four-Hour Chart

MACD and RSI Confirms the Market Indecision

The Moving Average Convergence Divergence (MACD) indicator validates Chainlink price consolidation. This is illustrated by its sideways movements just below the zero line as seen on the 4-hour chart. Moreover, RSI is in the mid-ranging, which is a show that the pressure from buyers and sellers is cancelling out hence consolidation of the LINK price.

On the upside, the MACD is indicating a bullish outlook as the MACD line (blue) is currently above the signal line. This bullish outlook will be corroborated once the MACD crosses the zero-line into the positive region. If this happens, Chainlink bulls are likely to push the LINK price through the BB’s upper band and will meet a first resistance confluence by the 50-Day SMA and a resistance at $18.98. However, a break through this resistance could rally Chainlink price higher but it could meet major resistance at $20.52 as bulls attempt to reach the two-week high at around $21.

It is important to stay informed about these crypto signals to know when to enter the market once the break out takes place.

Looking to buy or trade Chainlink now? Invest at eToro!

Capital at risk