- President Donald Trump has been clashing with China throughout his presidency.

- Beijing would prefer the maneuverable incumbent over his rival.

- Several Asian currencies may fall if Trump wins and China has a free hand.

“Kong flu” is President Donald Trump’s racist phrase to put accuse China of coronavirus. The president that vowed “only I can fix it” has not taken responsibility for mishandling COVID-19 and portrays himself as a protector of America. However, his narcissism – as his niece Mary Trump diagnosed – would keep China more than happy.

Democrat challenger Joe Biden – who appears in Republican ads as “Beijing Biden” – may prove a more significant rival to the world’s second-largest economy.

1) Trump can be bought with soybeans

The president is focused on himself and on his reelection chances. Having won the White House by slim margins in several states – losing the popular vote – he aimed to please farmers. His tariffs on China led to counter-levies on agricultural goods, including soybeans, which are in high demand across the Pacific.

To compensate for weaker Chinese demand, the administration paid farmers around $28 billion in two separate packages. Republicans are fiscal hawks and free-traders only when they are in opposition. Impeding trade with tariffs and providing aid to struggling sectors used to be a leftist policy.

Trump eventually struck a deal with China – Phase One – it included targets for buying soybeans and other products. The party of Reagen seemed to abandon a market economy in favor of Chinese-style state-managed capitalism – everything for re-election. According to former National Security Adviser John Bolton, Trump pleaded his Chinese counterpart Xi Jinping to buy agricultural products to help him win.

Nevertheless, Iowa, where beans are aplenty, is now a swing state rather than a solidly Republican one.

While the agreement consists of clauses that aim to address China’s theft of Intellectual Property – but leaves open questions about enforcement. Long-term issues were left for Phase Two – until after the elections.

China prefers a president whose buttons’ can be pushed.

2) Businessman Trump has ties with China

The Bank of China helped finance the 1290 Avenue of the Americas building in which Trump owns a significant stake. Another state-owned entity is a tenant at Trump tower. Construction companies owned by Beijing are involved in projects in the United Arab Emirates and Indonesia.

Both the president and his daughter Ivanka Trump have been awarded trademarks by China, Overall, he has over 100 trademarks in China as of early 2017:

Source: Quartz

Son-in-law Jared Kushner has courted Chinese investors in a real-estate deal. The lack of transparency of the Trump Organization – and his refusal to release his tax returns – are probably there for a reason. He potentially has other secrets to hide.

China has personal pressure points in addition to political ones.

3) Taiwan after Hong Kong and North Korea

Beijing has been watching Trump’s dealings with North Korea, its neighbor. The president had three historic meetings with dictator Kim Jong-un that included the US suspending military drills with South Korea.

Enthusiasm for peace is in the conflicted peninsula may be a price worth paying – yet Trump’s achievements are hard to find. North Korea continues holding onto its nuclear arms and ballistic missiles.

While China distances itself from the rogue North Korean regime, it would like to prevent reunification and keep US soldiers away from its border. With Trump, who prefers the photo-ops with Kim over substance, that goal is more achievable.

Beijing has recently passed a new security law for Hong Kong – considerably tightening the grip on the city-state and the world’s third-largest financial hub. President Xi Jinping seized the focus on coronavirus and also Trump’s weakness to make the move. While Secretary of State Mike Pompeo has been vocal in criticizing China, the sanctions proposed amount to a slap on the wrist to a child that has stolen something.

Will China promise to stop? Perhaps, but if Trump wins a second term, it may aim for a more significant move – against Taiwan. Recent statements talk about a “peaceful reunification” with the island that broke away from Communist China in the mid-20th century.

US aircraft carriers and battleships occasionally conduct “freedom of navigation” operations in the South China Sea, attempting to deter China from making a move. But will Trump prevent a Chinese takeover of Taiwan? Given his North Korea and Hong Kong policies, Beijing may seize the next distraction to bring Tapei under its rule.

Source: Pacific Sentinel

4) Biden worked to isolate China

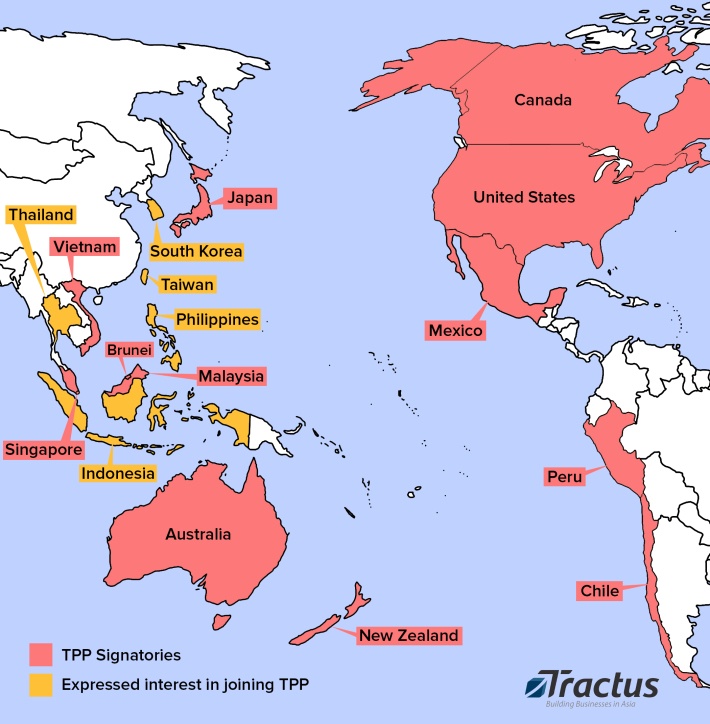

China is also rooting for Trump due to the past of his rival Joe Biden. The then-Vice President worked with his boss Barrack Obama on the Trans-Pacific Partnership (TPP) – a trade agreement including 12 countries around the world’s largest ocean. The accord included around 40% of the world’s Gross Domestic Product – with one substantial exclusion, China.

Source: Tractus

The goal was to isolate the world’s second-largest economy and set standards that China would later have to adhere to. Trump canceled the multilateral deal as one of his first actions in office, opting for a bilateral accord with Beijing. Biden could reverse that.

5) Trump pushes Europe toward China

Trump did not only anger partners in the Pacific but also across the Atlantic. The president called the EU a foe, supported Brexit which weakens the bloc, and bashes it for not supporting NATO.

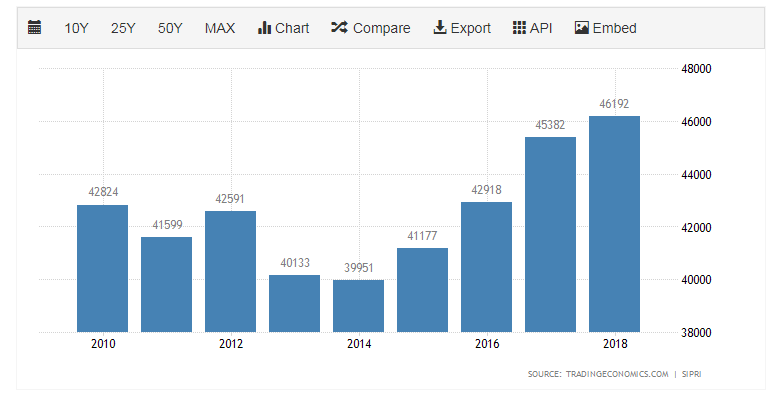

German military spending has bottomed out in 2014 and is on the rise. That can be attributed to both Obama and Trump’s nudging of Europe’s largest economy – or perhaps of Berlin’s fear that it cannot trust America. Chancellor Angela Merkel cast doubts about being able to rely on Washington.

Source: Trading Economics

As like-minded democracies which presided over the post World War II order were falling apart, China has been more able to enter that crack

Chinese investment and political pressure have been growing in recent years, including via the “Belt and Road” initiative. While Europeans suspect Beijing’s interests and disdain its authoritarian regime, the lack of strong backing from America makes weaker countries more vulnerable to China’s influence.

Another term for Trump may encourage further soft-power and aggressive economic moves into the old continent. Yet if Biden, who has good ties with European allies, enters the White House, Atlantic ties could strengthen and push China out.

Market impact

Asian currencies may suffer if Trump is elected – amid prospects of further Chinese moves. The most vulnerable ones would be the South Korean Won and the Taiwan Dollar. Stock markets in both countries could also come under pressure.

The Chinese yuan may also weaken – President Xi Jinping may feel freer to boost the country’s exports, a model that has been working for years. China’s stock market would continue its rise, owing to better prospects for Chinese firms.

US companies operating in China may come under increased pressure and the ever-elusive dream of operating freely in the country’s huge market may fade further away. Firms less-reliant on the world’s second-largest economy may fare better.

The broader stock market and the US dollar will likely react to other aspects of the presidential elections – not only the Chinese angle.

Conclusion

China has all the reasons to wish for a second Trump turn – the president’s self-centeredness, obscure business interests, the potential of choking Taiwan after doing so to Hong Kong, and opportunities that the incumbent creates by abandoning America’s post-WWII role are all in the mix.

More about the elections:

- 2020 US Elections: See you in September

- Three reasons why Biden’s lead over Trump is far greater than Clinton’s in 2016

- Be careful of judging the campaign before it starts

- Trump loss, split Congress is what markets want, most likely scenario out of four

- Timetable for trading the political event of the year