With the final seats being decided upon, we could get a less hung parliament than the one that was evident a few hours ago, when pound/dollar hit a low of 1.2635. While no party has an absolute majority, the Conservatives could continue governing.

With 318 seats, May’s Tories could find support from the Northern Irish DUP party that has 10 seats. At 328, they have more than half of the 650 seat chamber. It could be either in the form of a coalition or a minority Conservative government supported from the outside.

This would naturally be a very unstable government, dependent on a very small party that could have leverage. The LibDems sat in coalition with CON between 2010 and 2015 but the centrist party was beaten by the electorate and are unlikely to repeat that experience.

There are also doubts about the future of PM Theresa May. She called the election in order to enlarge her 330-seat majority to perhaps 400 and her gamble failed. Calls for her resignation are beginning to emerge.

Update: May will go to Buckingham Palace at 12:30 UK time (11:30 GMT) and ask permission to try and form a government.

UK elections – all the updates in one place

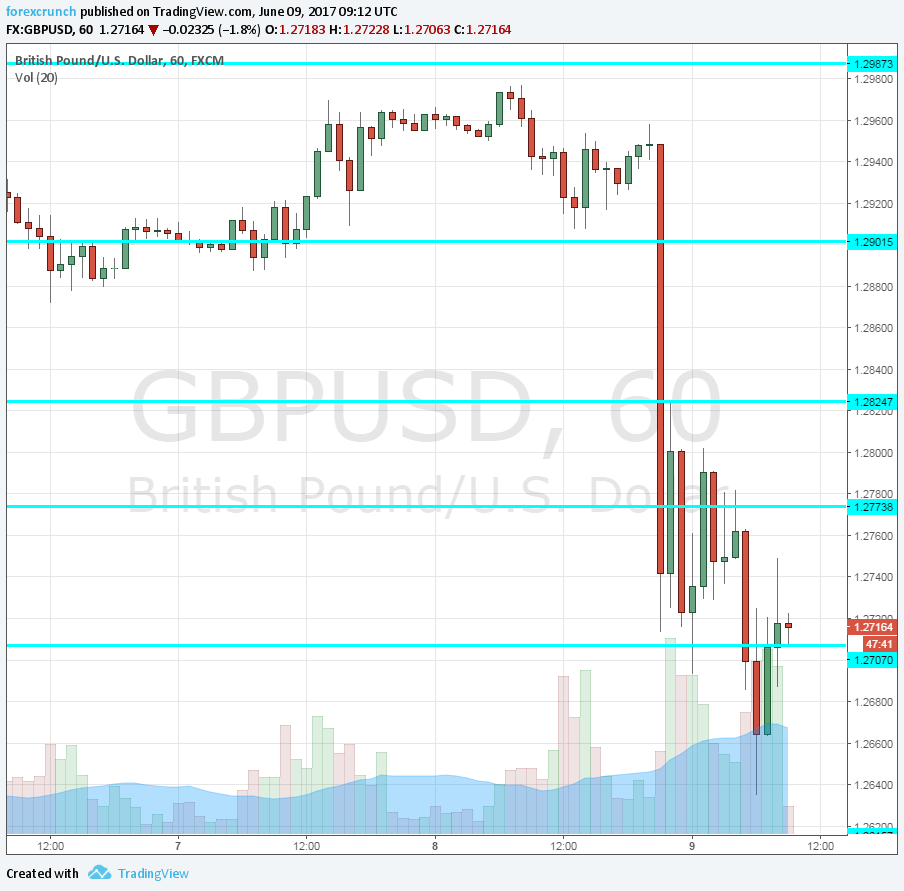

GBP/USD stabilizes

Is the market hoping for the Conservatives to cling to the power given these last seat allocations? Some hope for a delay in Brexit following the delay in forming a new government.

There is a good chance for yet another round of elections to clear the uncertainty, and in the meantime, we could have more uncertainty.

Nevertheless, GBP/USD is already 80 pips off the lows at 1.2715, above the round level of 1.27. Resistance awaits at 1.2770, followed by 1.2825. Even higher, 1.29 is a level to watch.

On the downside, we find 1.2915, 1.2540 and 1.2350.