After a busy September 21st, we had the FED show a hawkish hold and the BOJ targeting the yield curve. The initial result is a weaker USD/JPY, but the team at Goldman Sachs sees a lot of upsides and explains:

Here is their view, courtesy of eFXnews:

The FOMC kept the fund’s rate unchanged while signalling a near-term hike. Our US economists think the statement indicates a clear bias to tighten in the relatively near future. The statement indicated that “the case for an increase in the federal funds rate has strengthened,” and noted that risks to the outlook were now “roughly balanced”. The decision also appears to have been a close call, with three committee members dissenting, the first time in five years that three voters have dissented in the same direction. The Summary of Economic Projections was a bit more dovish, showing one hike this year and two hikes next year, down from two and three, respectively.

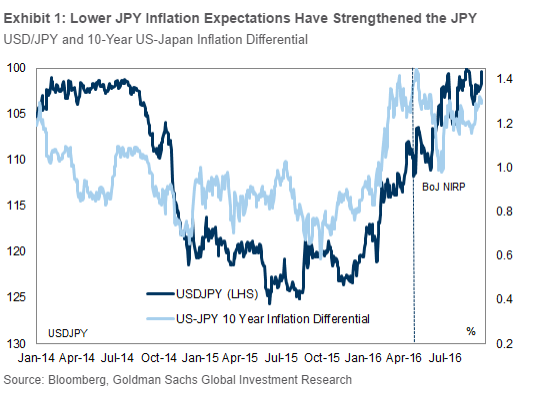

The bigger surprise was the BoJ’s decision to shift from quantity targets to price targets. The Yen, rates and equity indices all rallied in response. We expect the rally in the Yen to reverse, as this policy shift should help address market concerns about the scarcity of JGBs, thus increasing the sustainability and credibility of continued monetary accommodation. The “inflation overshoot” language is also a fundamentally dovish shift, mostly setting up QQE ad infinitum.

Our Rates team have left their end-2016 bond yield forecasts unchanged at 2% for 10-year Treasuries, 5bp for JGBs, 30bp for German Bunds and 1.25% for UK Gilts while our FX team sees considerable upside for $/JPY in the coming days

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.