The general notion is that the Federal Reserve is on track to hike in 2015, with June and September serving as the main time candidates.

But can the strength of the greenback, weighing on inflation and exports delay the central bank from raising the interest rate? The team at SEB weighs in:

Here is their view, courtesy of eFXnews:

Although the USD has appreciated by around 35% in trade weighted terms since May 2014 the Fed has shown little concern so far, notes SEB Group.

So what has happened to financial conditions on the back of the stronger dollar since last summer?

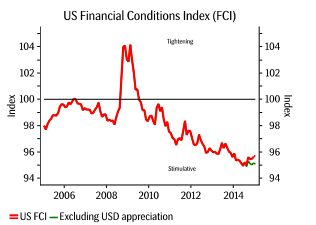

“There are obviously different ways of calculating US financial conditions. However, we believe that the influence on financial conditions from the USD generally is quite small, just as on the overall economic activity. Therefore, the SEB financial conditions index (FCI) for the US has a fairly small weight related to the dollar. The chart below illustrates the US FCI since 2005. Currently low interest rates, rising equities and low credit spreads altogether contribute to extremely loose financial conditions in the US,” SEB argues.

“This illustrates quite well why the Fed probably isn’t overly worried of the impact on financial conditions from a stronger dollar. Instead the Fed is likely monitoring what happens to US bond yields, credit spreads and the equity market as these will be decisive for financial conditions and therefore for the timing and the pace of future rate hikes,” SEB adds.

LOWER BOND YIELDS OFFSET A STRONGER DOLLAR.

“We expect that US bond yields will follow global interest rates lower amid downside pressure on inflation from low energy prices and increased bond purchases by central banks. The 10 year US bond yield could therefore fall by as much as around 20-30 basis points in coming months. Consequently US financial conditions are likely to ease rather than tighten in coming months despite a stronger dollar,” SEB projects.

“In this perspective further dollar strength is unlikely to be critical for the Fed and will not be enough to delay or stop the Fed from tighten policy in H2 2015,” SEB concludes.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.