The markets are coming around to seeing QE as imminent in the euro-zone, and the recent report about a plan of 500 billion euros adds a sense of confirmation.

When Draghi opens his mouth on January 22nd, can we expect a rally in the euro as QE is already priced in? The team at JP Morgan provides a different argument backed by a nice chart:

Here is their view, courtesy of eFXnews:

Could ECB QE mark the low in EUR/USD in typical buy-the-rumor-sell-the-fact fashion? Short answer: Unlikely, says JP Moragn.

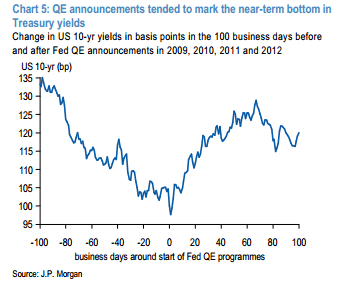

“It is true that Treasury yields exhibited a buythe-rumour-sell-the-fact patterns in that they rallied on average into the four Fed QE announcements and retraced higher thereafter. They same could happen with German bund yields, which is part of the reason we forecast 10-yr Germany around 0.85% by end-2015. But Fed QE did not, on average mark local lows in the dollar, for those thinking technically,” JPM argues.

“For those thinking contextually, the main reason to think that that an ECB QE announcement should not market a low in EUR/USD is that such ECB easing will occur alongside Fed tightening,” JPM adds.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.