The decline of the EURUSD JUST MIGHT be one of those graphs we look back on in December and say “that was the trade of the year”. It looks like Mario Draggi threw the bears a bone hinting that he would wait and see some June data before perhaps adding some stimulus.

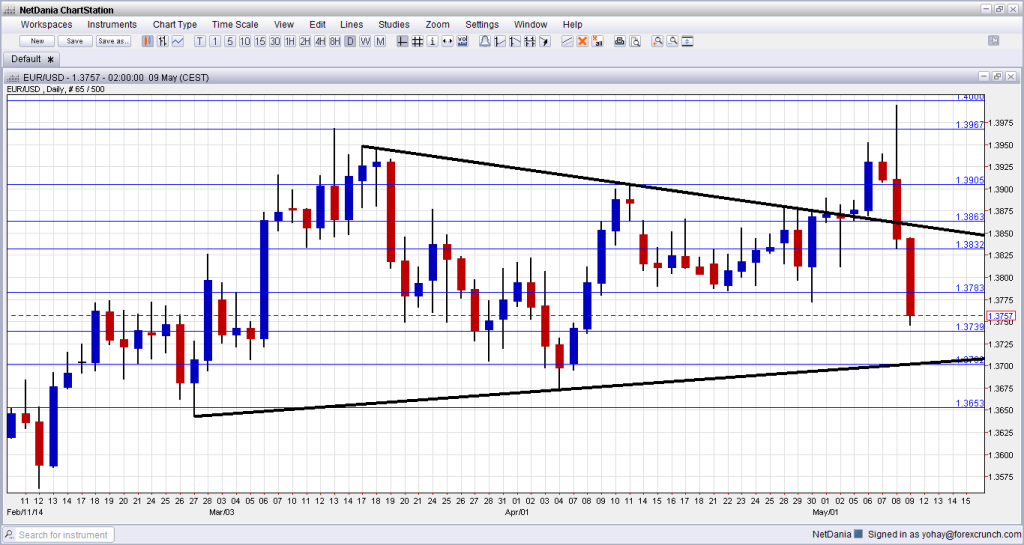

As the fundamentals and the technicals were not lined up I was not prepared to buy any break out to the upside but a declining Euro would be a different story. After hitting a session high of 1.3990 we put in an outside candle and closed near the lows at 1.3841. This drop takes back all of the pre-central bank strength but I won’t get too excited yet.

Here is the chart:

More EUR/USD at the weekly euro dollar prediction.

Keep in mind we are still locked in sideways consolidation and we would need to see a close below key support at 1.3671 to give some more re-assurance to the bears. Looking at the monthly price action it would not at all be surprising to see this pair in the 1.20’s by year end. Such an event would help the ECB fend off its critics (especially in France and Italy), it would help exports and growth and it would go a long way to preventing deflation which would meet the ECB’s mandate of “price stability”.

All of a sudden I really like this trade but let’s not get ahead of ourselves. We need to get out of this sideways consolidation first. As I write we are set up with a weekly shooting star candle so let’s see if we close tonight looking the same. – See more at: http://www.fxlight.co