- Markets are souring on the COVID-19 ramifications for global economy.

- China faces a potential second wave of coronavirus infections.

At the start of the week, markets cheered the developments towards a possible breakthrough with respect to a vaccine for COVID-19. We heard that volunteers who received Moderna’s vaccine had positive early results, according to the biotech company, which partnered with the National Institutes of Health to develop the vaccine.

However, while markets awaited to hear more feel-good headlines pertaining to the prospects of a possible vaccine to be made available to the public as early as January a Stat News report poured cold water over the news on Tuesday. Citing experts, according to the health-focused Stat News, the experiment was said to not provide the critical data needed to assess its effectiveness. The concerns noted by Stat included:

– a lack of data about the responses to the medicine from other participants in the 45-subject study

– lack of information about the ages of the eight subjects whose antibodies were analyzed, an important question given the virus is particularly lethal to older people

– lack of comment from Moderna’s U.S. government partner on the vaccine, the National Institute for Allergy and Infectious Diseases

– the data is based on early responses to the vaccine, leaving unclear how long any immunity produced by the vaccine might last.

Moderna did not immediately respond to a Reuters’ request for comment. The stock price took a beating and plummeted by 10.4% in late Tuesday action to almost pare back a 13% surge on Monday which brought it to a record close.

New waves of the virus expected

After months of lockdowns and curbs on travel China has largely brought the virus under control. However, China’s government’s senior medical advisor has warned that China faces a potential second wave of coronavirus infections due to a lack of immunity among its population. Fears of a second wave have risen as clusters have emerged in northeast provinces and in the central city of Wuhan.

“The majority of… Chinese at the moment are still susceptible of the COVID-19 infection, because (of) a lack of immunity,” Zhong Nanshan, the public face of government’s response to the pandemic, told CNN.

“We are facing (a) big challenge,” Zhong added. “It’s not better than the foreign countries I think at the moment.”

Chinese COVID-19 updates

- China reports 5 new COVID-19 cases on the mainland as of end May 19 (vs. 3 days earlier).

- Reports 1 new imported COVID-19 case in the mainland (vs. 3 a day earlier).

- Reports 16 new asymptomatic COVID-19 cases in the mainland (vs. 17 a day earlier).

Hold your horses

It is all too easy to get caught up in the hysteria of the geopolitical headlines, but the fact is, the macro is far easier to predict and to trade than highly unforgiving and fickle political headlines or COVID-19 updates that can turn on there head within a day. No one wants to be a pessimist, but a touch of realism is critical and keeping a cool and analytical head will go a long way in keeping you out of bad trades.

The World Health Organisation has said earlier in the year that it would be at least 18 months before a vaccine against the coronavirus is publicly available. Perhaps markets are too keen to get back to positive levels and are getting too ahead of themselves?

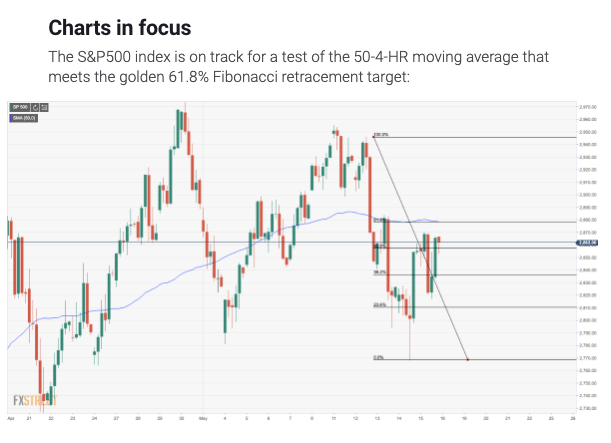

At the start of the week, we were looking at the US benchmarks as a guide and the 61.8% Fibonacci retracements:

This level is indeed proving to be a tough area of resistance and the path of least resistance is probably to the downside if investors begin to price in the reality of the broader risks associated to the state of the global economy.