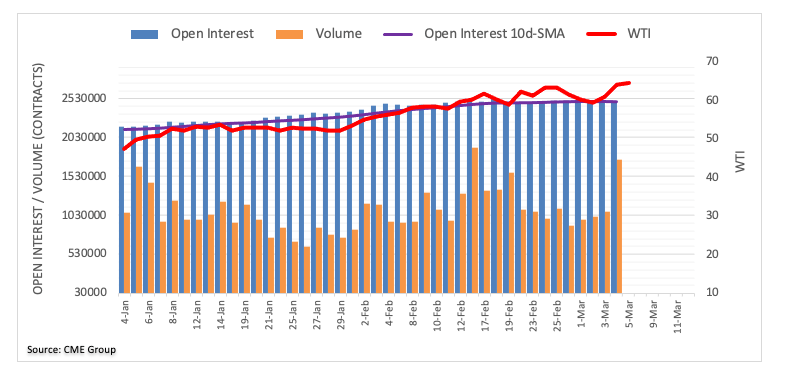

Traders scaled back their open interest positions in crude oil futures markets by nearly 14K contracts on Thursday in light of flash data from CME Group. On the other hand, volume extended the uptrend for another session, this time by almost 660K contracts, the largest single-day build since January 4.

WTI navigates YTD highs above $64.00

The barrel of WTI finally clinched the $64.00 mark (and above) following the key OPEC+ meeting on Thursday. The daily advance, however, was in tandem with shrinking open interest, hinting at the probability of a corrective downside in the very near-term. Reinforcing the latter, there is a bearish divergence in the daily chart in the RSI.