- Venezuela economic crisis combined with potential further US sanctions can lead to a big oil supply squeeze.

- Earlier in the day, the Energy Information Administration reported a lower crude oil stockpile than anticipated at -1.404M versus -0.763M.

Crude oil West Texas Intermediate (WTI) is trading at around $71.47 a barrel up 0.78% on Wednesday.

The economic crisis in Venezuela is hitting its crude oil production which in recent months dropped to 1.4 million barrels a day (bpd) which represent almost a 40% drop since 2015. Creditors are closely monitoring the country’s assets and the US is considering to impose further sanctions on Venezuela. The critical situation in the country can lead to a supply squeeze and potentially send oil prices even higher.

Referring to the upcoming election in Venezuela, Tamas Varga, analyst at PVM Oil Associates commented: “Maduro will win as the election is rigged and it won’t be fair. The more important question is how the US will react after the official results. If US refineries are forbidden from buying Venezuelan crude then you’d have to imagine the country is in trouble.”

Meanwhile, the OPEC (Organization of the Petroleum Exporting Countries), in its April report, raised their demand forecast by 25,000 bpd to 1.65 million bpd. Reason for the upward revision was attributed to better-than-expected economic data in OECD countries (Organization for Economic Cooperation and Development). OPEC added that better economic data in China, India and Latin America would likely push oil demand higher. OPEC said that they were convinced that the biggest oil glut in history has been virtually eliminated.

Crude oil prices are also on the rise because the US has recently withdrawn from the Iran nuclear deal which can potentially put at risk up to 500,000 bpd, according to analysts.

Meanwhile, earlier in the day, the Energy Information Administration reported a lower crude oil stockpile than anticipated at -1.404M versus -0.763M which is seen as bullish.

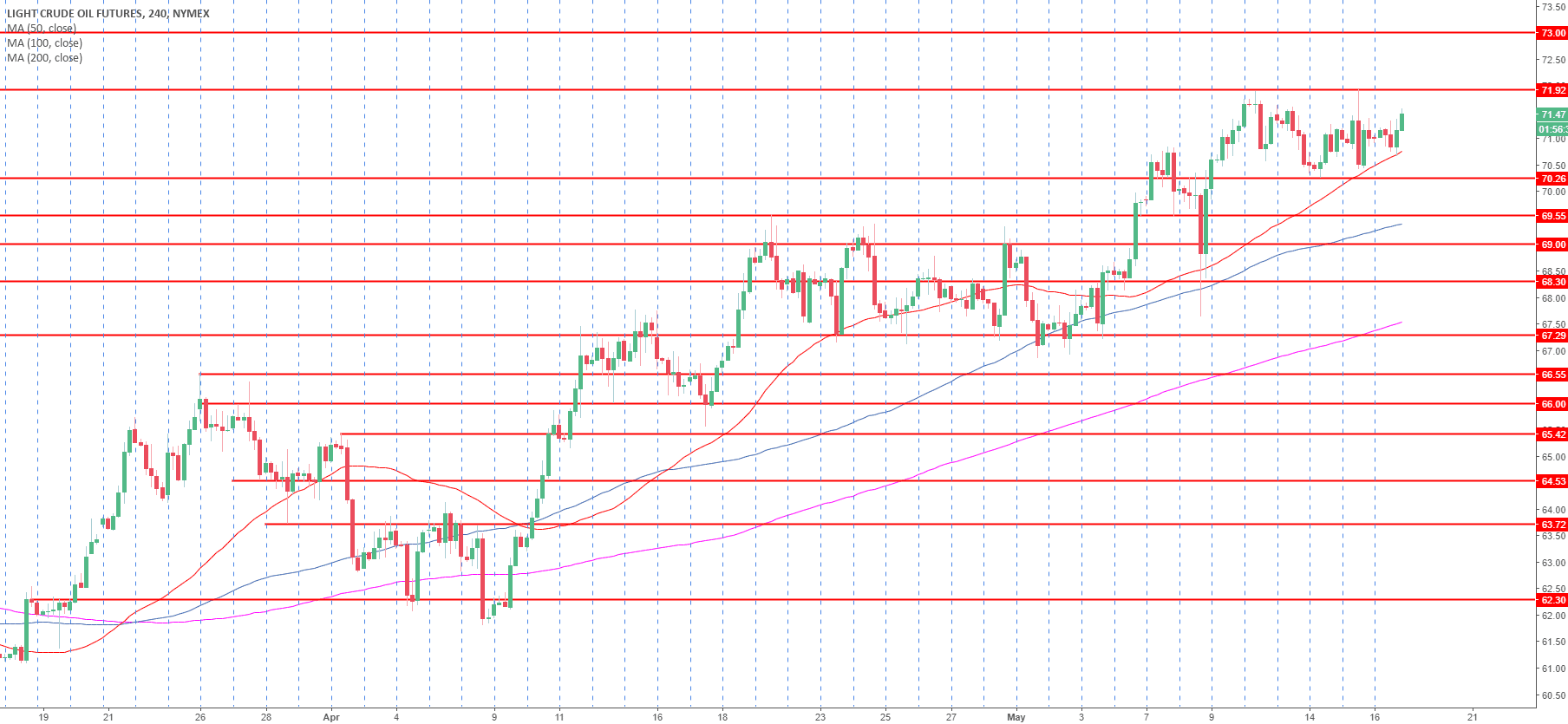

Crude oil WTI 4-hour chart

Crude oil is in a strong bull trend, resistances are seen at the 71.92 swing high, 72.00 and 73.00 psychological levels. To the downside, bears will likely meet support at the 72.26 and 69.55 swing lows followed by the 69.00 psychological level. The market is trading above its 50, 100 and 200-period simple moving averages on the 4-hour time-frame suggesting a strong upward momentum.