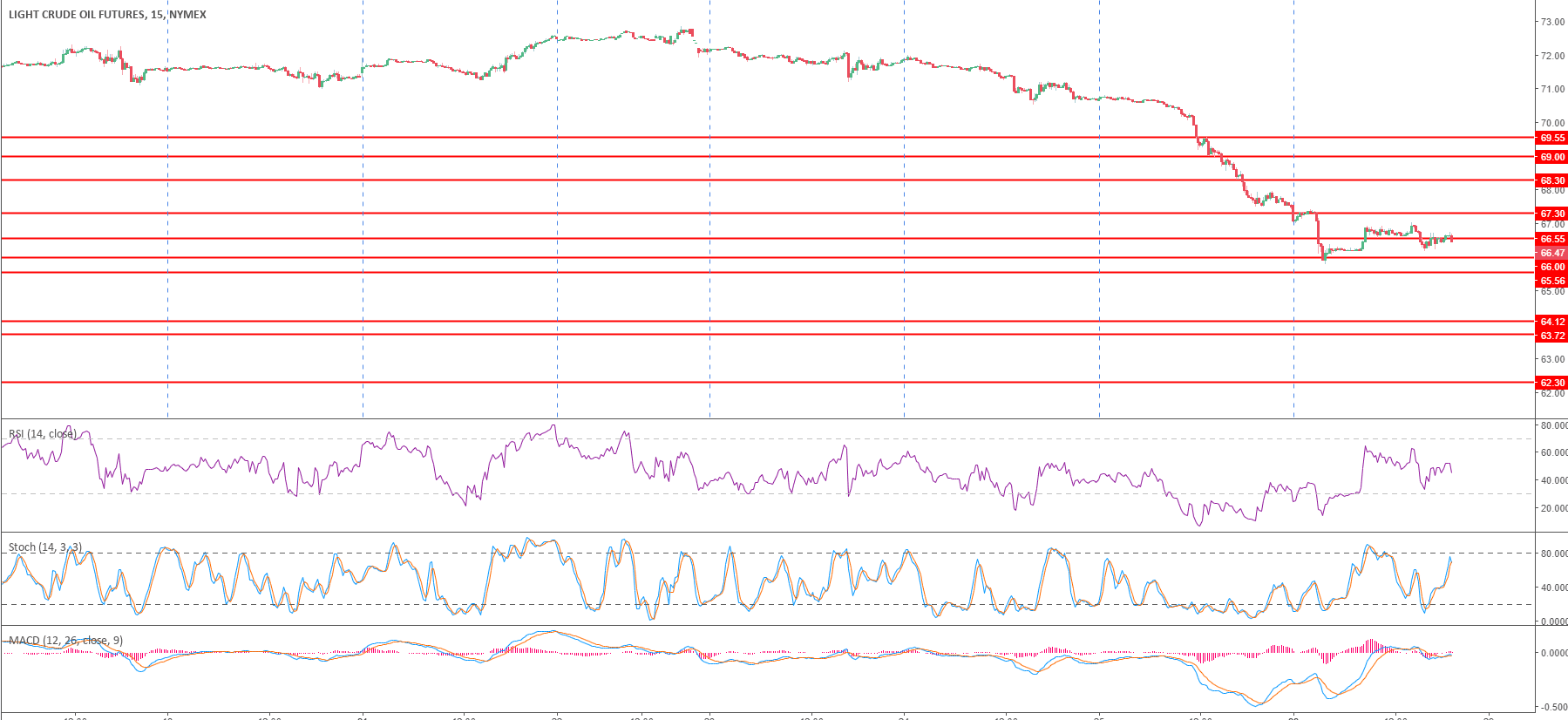

- WTI tanked almost 10% in the last 4 sessions as it reached a weekly bullish trendline.

- The market is consolidating the strong sell-off of the last few days as the market is deliberating between more losses or a resumption of the bull trend of the last months.

- A move above $67.00-$67.30 a barrel can open the gates to a reversal up, although it feels slightly premature at this stage.

- A strong break below 66.00 can see an extension of the bear move towards the 64.00 handle.

Crude oil WTI 15-minute chart

Spot rate: 66.46

Relative change: -1.22%

High: 67.50

Low: 65.78

Trend: Bearish

Support 1: 66.00 handle

Support 2: 65.56 April 17 low

Support 3: 64.12 April 5 high

Resistance 1: 67.30 major support/resistance

Resistance 2: 68.30 major support/resistance

Resistance 3: 69.00 handle