- Crude oil pushed as high as 70.70 so far this Tuesday, just one tick shy from the 70.71 resistance, the November 17, 2014 low.

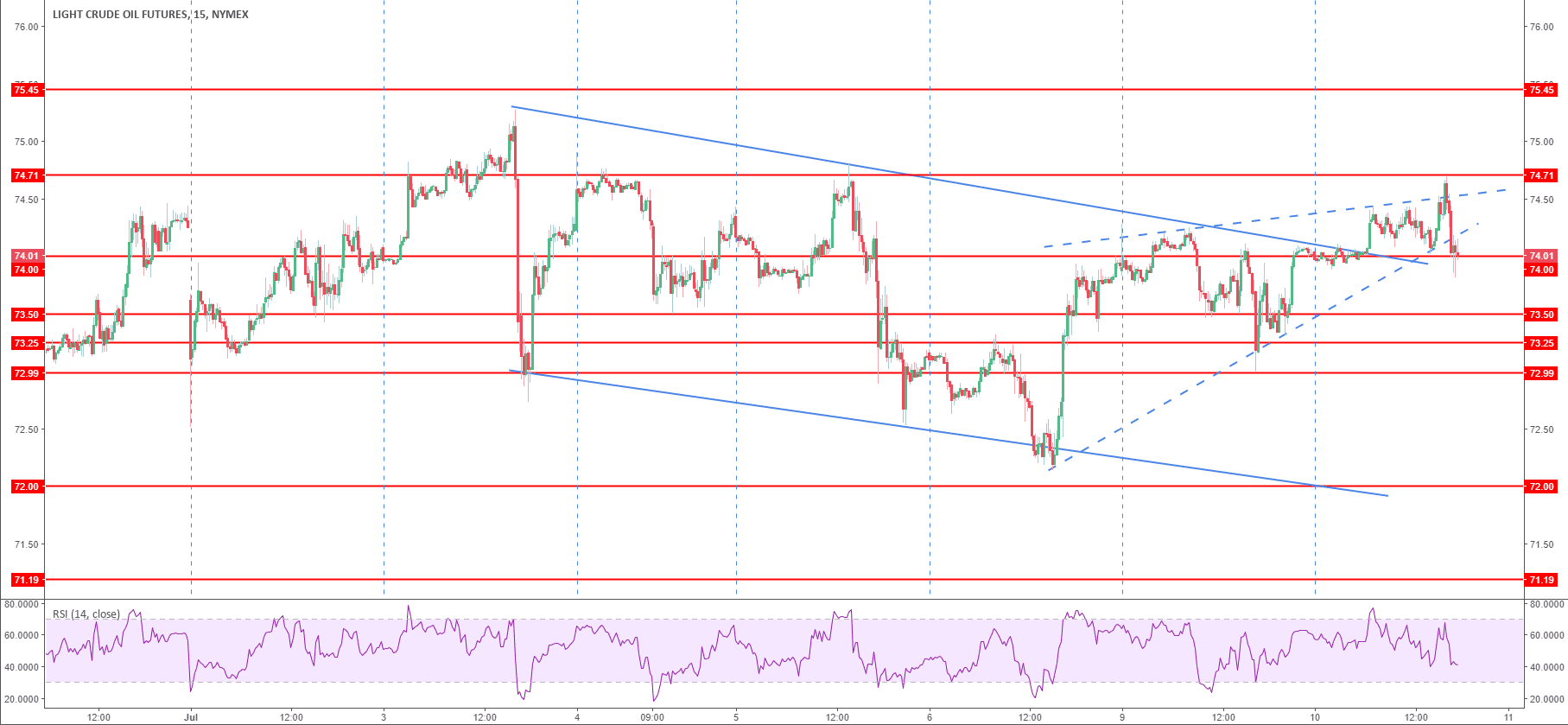

- Crude oil has been grinding higher in a wedge shape (dotted line) above the bearish upper trendline in the last three days suggesting that bulls might actually be in a bull trap.

- However, a bull breakout above 74.71 should lead to bear capitulation and the market can spike to 75.27 the current 2018 high.

Spot rate: 74.01

Relative change: 0.03%

High: 74.67

Low: 73.78

Trend: Neutral to bearish

Resistance 1: 74.71 November 17, 2014 low

Resistance 2: 75.27 current 2018 high

Resistance 3: 75.45 November 24, 2014 low

Resistance 4: 76.00 figure

Support 1: 74.00 figure

Support 2: 73.25 November 14, 2014 low

Support 3: 73.00 figure

Support 4: 72.83 June 27 swing high

Support 5: 72.00 figure

Support 6: 71.19 May 23 low

Support 7: 70.53 May 24 low