- Cryptos ended the recent consolidation and are now sliding.

- The technical picture has worsened for all top three digital coins.

- Here are the levels to watch according to the Confluence Detector.

Bitcoin got close to 4K while Ethereum and Ripple surged. However, after the necessary correction and consolidation, things have worsened and cryptos are moving south below critical technical levels.

The good news that Samsung enables cryptos in its latest Galaxy S 10 phones does not help. Neither do hopes that the SEC is moving forward with its dealing regarding a Bitcoin ETF.

Will cryptocurrencies weather this storm?

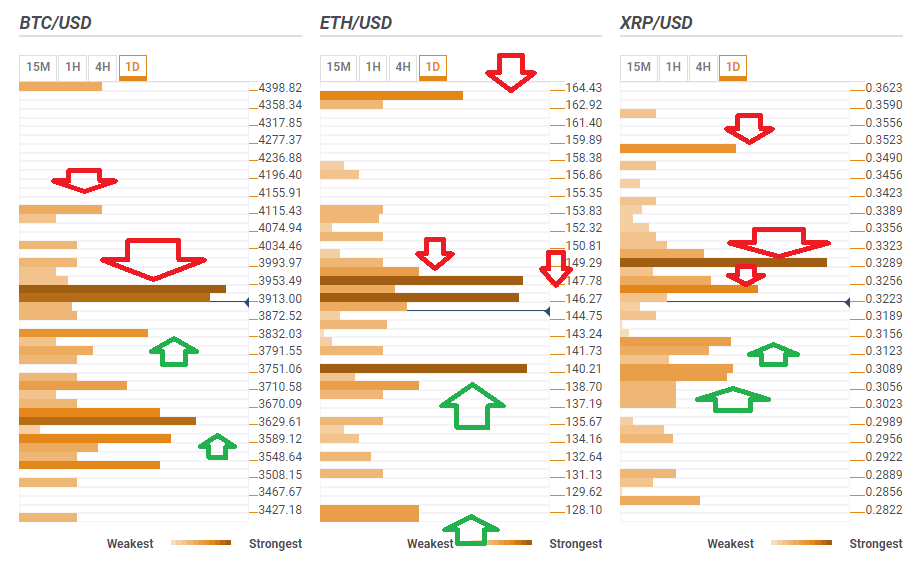

This is what the Crypto Confluence Detector shows in its latest update:

BTC/USD faces resistance at $3,933

Bitcoin, the grandaddy of cryptocurrencies, slipped under a critical cloud of caps. At $3,933 we find a dense cluster including the Simple Moving Average 200-15m, the SMA 501h, the SMA 10-4h, the SMA 50-15m, the SMA 50-15m, the Bollinger Band 1h-Middle, the Fibonacci 38.2% one-day, the SMA 5-4h, the BB 1h-Lower, the SMA 10-15m, the PP 1m-R1, the Fibonacci 61.8% one-day, and the SMA 5-1h.

It will be hard for BTC/USD to overcome such a resistance area. If it makes it, it would target $4,115 which is the meeting point of the PP 1d-R3 and last month’s high.

Looking down, some support awaits at $3,832 where we see the convergence of the Fibonacci 61.8% one-month, the SMA 100-1h, and the Pivot Point 1d-S2.

Further down, $3,629 serves as another support line. It consists of the Fibonacci 38.2% one-month, the PP one-week R1, the Fibonacci 61.8% one-week, and the SMA 50-1d.

ETH/USD faces double resistance

Ethereum is suffering a worse situation. At $146, Vitalik Buterin’s brainchild faces a confluence of levels including the BB 4h-Middle and the PP 1m-R1.

Close by, at $147.80, ETH/USD will meet a minefield including the Fibonacci 38.2% one-day, the previous 4h-low, the SMA 100-15m, the SMA 10-1h, the BB 1h-Middle, and the SMA 50-15m.

The upside target is $163.30 which is where the PP 1d-R3 and last month’s high converge.

Looking down, ETH/USD has quite a bit of support at $140, where the powerful Fibonacci 61.8% one-month meets the SMA 5-1d.

However, if it falls, it could stumble all the way down to $128.10 where we see the convergence of the PP 1w-R1 and last week’s high.

XRP/USD also capped

Ripple faces weak resistance at around $0.3230 which is the confluence of the SMA 100-1h, the SMA 50-1d, the PP 1d-S1, and the Fibonacci 161.8% one-week.

More significant resistance awaits at $0.3303 where we see a dense cluster including the SMA 10-1h, the BB 4h-Middle, the SMA 50-15m, the PP 1w-R3, the BB 1d-Upper, and the BB 1h-Middle.

Support awaits at $0.3135 which is the meeting point of the SMA 50-4h, the SMA 200-1h, the previous weekly high, and the PP 1d-S2.

The next support line is at $0.3070 where we see the SMA 100-4h, the PP 1w-S3, and the BB 1d-Middle.