- EUR: The pattern of events in Cyprus is ever-changing, so the scope for volatility remains high throughout the day. Late yesterday, the Cypriot central bank governor outlined two parliamentary bills designed to ensure banks could re-open on Tuesday with continued ECB support. These bills, along with others, will be discussed through today. The ECB has stated that emergency funding will be halted on Monday should no deal be found.

- USD: Data is on the light side for today, with just Fed revision of industrial production slated.

Idea of the Day

The pressure is on today, with the Cypriot parliament set to debate a number of bills and measures designed to satisfy the EU and the ECB that Cyprus can put its finances on a sufficiently stable footing to allow the EUR 10bln bailout from the EU/IMF to be finalised.

The fact that Russia has stepped back from providing immediate assistance has put the single currency on the defensive at the start of the European session, but this is just the start of what could be a long day, with few other distractions for FX markets beyond the German IFO data.

The performance of other currencies has been notable, the yen and sterling doing well, together with both the Aussie and kiwi. This is further proof, if it were needed, that the risk-on/risk-off dynamics of last year are very much dead in the water. For the single currency, the risks still appear to the down-side in the near-term, as there is no clean deal to be done that would lead to a strong rally in the euro.

Latest FX News

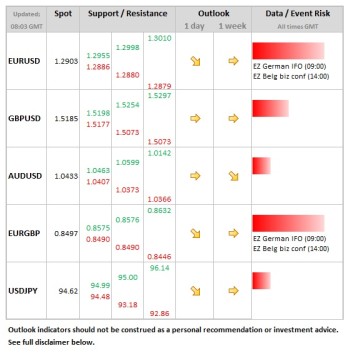

- EUR: The single currency was under modest pressure through Thursday owing to the on-going uncertainties in Cyprus. Support is seen around the 1.2877/90 area.

- GBP: The more bullish tone of late was enhanced by the stronger than expected retail sales data yesterday and the sigh of relief in the wake of the budget has also held. Sometimes this can fade as less bullish details are unearthed. Sterling is also benefiting at the margins from the less stable tone to the Eurozone. Short-term resistance on cable is seen at 1.5210.

- JPY: The yen received modest support from the more cautious news coming out of Cyprus. On the week, it remains one of the strongest performers, just the kiwi having done better. It’s looking ever clearer that further yen weakness can only be achieved via fresh stimulus measures from the new Bank of Japan governor and 4th April is the next BoJ meeting date.