The troubles weighing on Deutsche Bank have grabbed markets’ attention and also have their impact on the euro. However, EUR/USD remains well-entrenched in range. What’s next? Here are two different opinions:

Here is their view, courtesy of eFXnews:

EUR: ‘Stuck Between Deutsche and Deutschland’ – Credit Agricole

Concerns about the fate of the largest German lender have captivated investors’ attention of late. EUR has emerged relatively unscathed so far, however, and this seems to be due to several reasons.

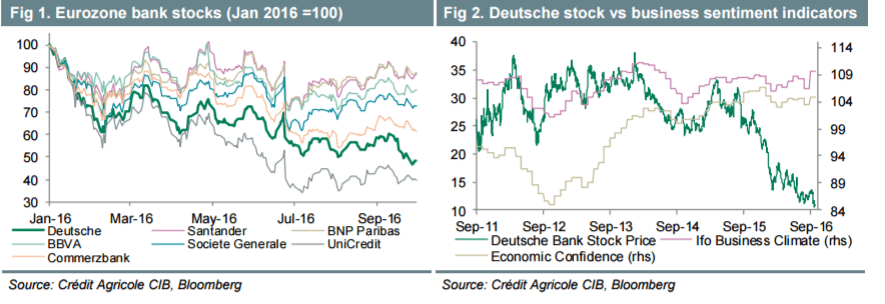

1. Investors still seem to view the Deutsche Bank troubles as an isolated incident with limited impact on the Eurozone banks, especially if one looks beyond Italy’s troubled lenders (Figure 1).

2. There is limited evidence that the Deutsche selloff is having a negative impact on German and European economic confidence (Figure 2).

We suspect that EUR is also holding up because of the unwinding of short-EUR hedges by investors trying to flee the Eurozone capital markets. A potential escalation of market concerns could trigger further unwinding of EUR-funded carry trades and support the single currency.

The downside risks for EUR should linger for now, as concerns about Eurozone banks may force the ECB to dig deeper into its monetary easing toolbox. Political uncertainty could also grow as investors’ attention shifts to the constitutional referendum in Italy on 4 December.

That said, EUR’s safe-haven appeal should limit the damage from any renewed selloff and we see EUR/USD at 1.1000 into year end. The European risk-correlated currencies (G10 or not) and GBP, as well as other G10 commodity currencies, may have to bear the brunt of any risk selloff in response to a deteriorating outlook for European banks.

3 Reasons Why This European Banking Crisis Won’t Hurt The Euro – Credit Suisse

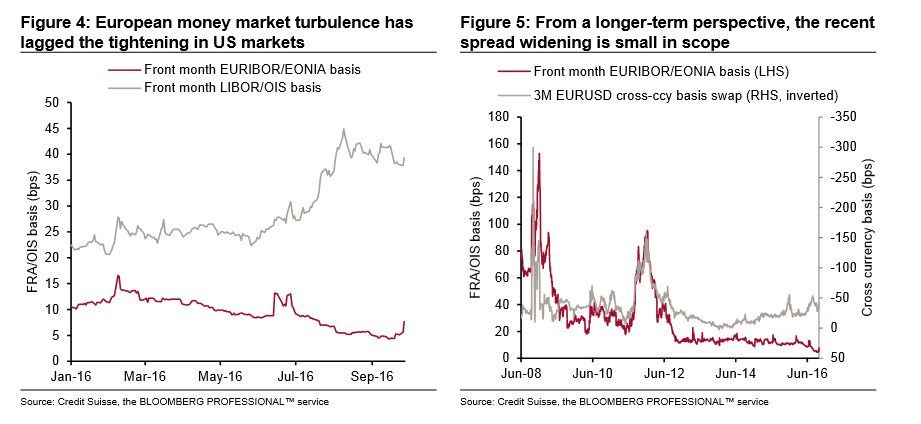

The G10 market has pirouetted away from its extreme JPY focus last week to consider the potential FX impact of European banking frailties. With a notable German lender under the microscope due to concerns about capital adequacy in light of potential fines and related problems, European equities and credit have come under a degree of pressure. This has spilled over to some extent to the FX market via a widening of the EUR basis towards the widest levels this year, though still far from the lofty levels seen in genuine crises such as 2008 or 2012

Historically, banking crises and widening basis would have quickly led to a weaker EUR and much higher realised and implied volatility. But so far, the latest stresses have had almost no discernable impact on these vol metrics despite starting points that were already very low.

We see three key reasons for this mild response as follows:

1. ECB liquidity and systemic stability: unlike 2012, many more ECB mechanisms with a range of acronyms are in play to support the wider system and provide easy access to liquidity. These range from OMT to TLTRO to QE among others, but also factors such as negative rates and excess deposits from other sources help too. This can be seen in Figure 4 and Figure 5. European money markets are not showing material signs of idiosyncratic stress. Dec IMM Euribor minus Eonia spreads have moved a touch higher but are easily lagging the move that money market reforms in the US prompted earlier in similar US LIBOR minus OIS spreads. And from a longer-term perspective, the spread widening in both Euribor minus OIS and the EUR basis is trivial. Also, the USD funding requirement of European banks is much lower than before 2012 due to lower operational requirements for USD-funded balance sheets

2. German policy: markets suspect the German government would not allow a major lender to fail, even if significant losses are imposed on shareholders and some creditors. This limits the capacity to generate systemic risk.

3. EUR is now a funding currency: unlike the period up to 2012, the euro area now systematically runs a large current account surplus, which both adds to excess liquidity and means that euro area investors provide rather than need capital flow funding on a net basis. This limits exposure to risk-off situations – indeed those that could trigger repatriation flows could even be helpful.

In this context, we take a relatively benign view of these events and maintain our EURUSD 1.15 three month target.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.