Despite annual deficits topping a trillion dollars, a slow recovery, a high unemployment rate and trillions in freshly created dollars from the Federal Reserve’s printing press (now with the new open ended model), the US dollar is not doing so bad under the 44th President of the US.

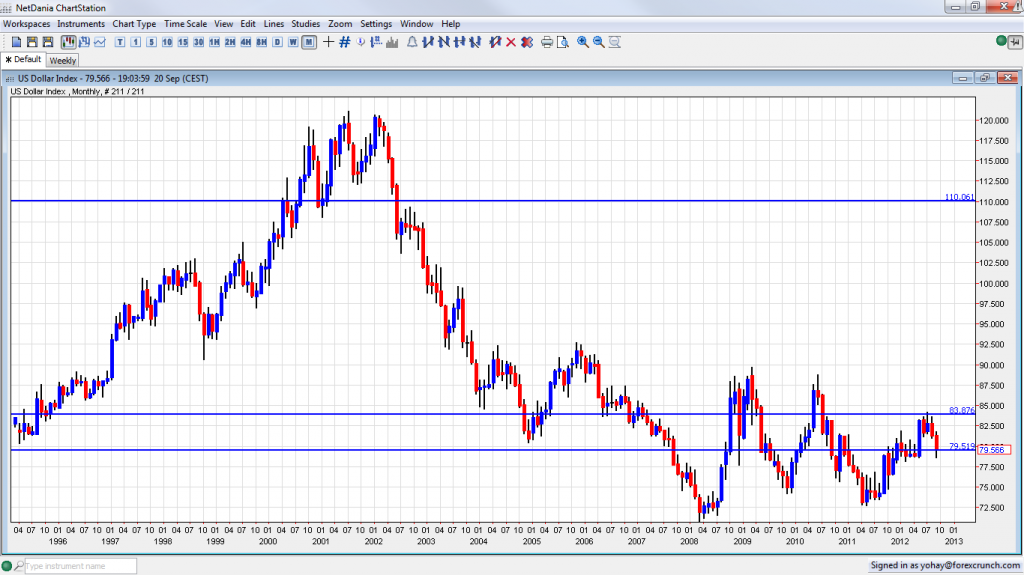

So far during the Obama’s term, the US Dollar Index slid from 83.6 (January 19th 2009) to 79.5 at the time of writing, September 20th 2012 – around 5% in 3 years and 8 months. Not too good, yet the previous period was far worse for the greenback:

During the period of George W. Bush, the US dollar Index slid from roughly 110 to 83.6 – a drop of around 24% in 8 years. Even when taking the difference in time periods, it is clear to see that the dollar lost less during the Obama than under Bush.

This can be seen on the chart:

The high line is the value when George W. Bush entered office, the middle line is when Obama came into power and the lower line is the value at the time of writing, September 20th 2012.

Needless to say, a lot of things happened in the US, in Europe, in China and everywhere during all these years. There are many factors moving the greenback, with central banks having a lot of impact on currencies. However, it is interesting to note that when looking back to history, there is a clear difference between the dollar’s performance under Democratic presidents and Republican ones.

A stronger dollar is important for keeping the dollar as a reserve currency, something that has been questioned various times in recent years. On the other hand, a weaker dollar is better for US exports. So, there are advantages and disadvantages anyway you look at it.

The value of the dollar isn’t a hot topic in presidential elections. Should it be?

Further reading: Dollar’s demise gathers pace