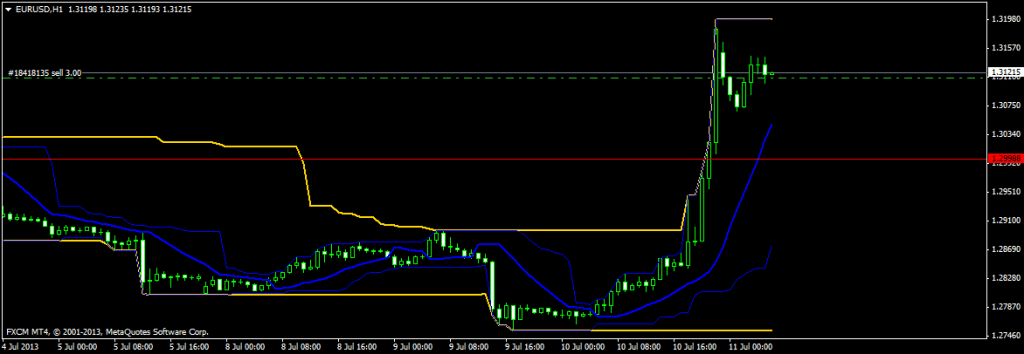

The greenback declined against most of its peers. Last night, after a very quiet European trading session, the dollar started to weaken strongly. The dollar index tumbled after Bernanke said the US economy still needs stimulus because the inflation and the unemployment rate are below target.

These words can affect the dollar in the longer term, so today we are going to have a very choppy day. What we see now is that the 20 days dollar strengthening period is over by now.

Technically the EURUSD could make a correction today and get back to test the 1.3000 level, but afterwards it could recover again, I bet on the bullish trend until end of this month.