The US dollar gained quite a lot in late 2014 and in the early days of 2015. Can this strength continue? There is potential, and the move could come from other sources.

Fiona Lake, Robin Brooks and Michael Cahill from Goldman Sachs explain:

Here is their view, courtesy of eFXnews:

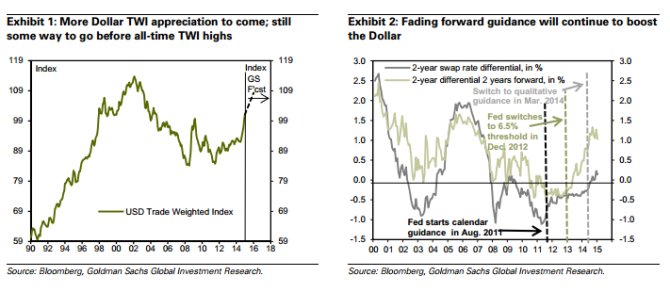

“We expect USD strength across the rest of the G10 complex to continue through 2015, with the USD likely posting a 7% appreciation versus the majors by end-2015 after the 10% appreciation recorded in the second half of last year.

So far, the majority of the USD TWI strength against the rest of the G10 has come from two non-Dollar factors: (i) substantial easing surprises by the BoJ and ECB and, to a lesser extent, Norges Bank and the Riksbank, alongside more dovish rhetoric from the Bank of England; and (ii) sharp falls in commodity prices have weakened the AUD and CAD.

Through 2015, we think the driver of Dollar strength will shift and that the USD will increasingly be driven by Fed policy and broader US domestic conditions.

Indeed, our conviction in our Dollar bullish view has gained ground as the Fed downgraded its forward guidance in recent meetings. We continue to expect the Fed to start tightening monetary policy at the September 2015 meeting. Our projections for Fed policy are marginally more hawkish than currently discounted by the market, particularly in the outer years of our forecast horizon.”

Robin Brooks, Fiona Lake and Michael Cahill – Goldman Sachs

&For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.