Technical Bias: Bullish

Key Takeaways

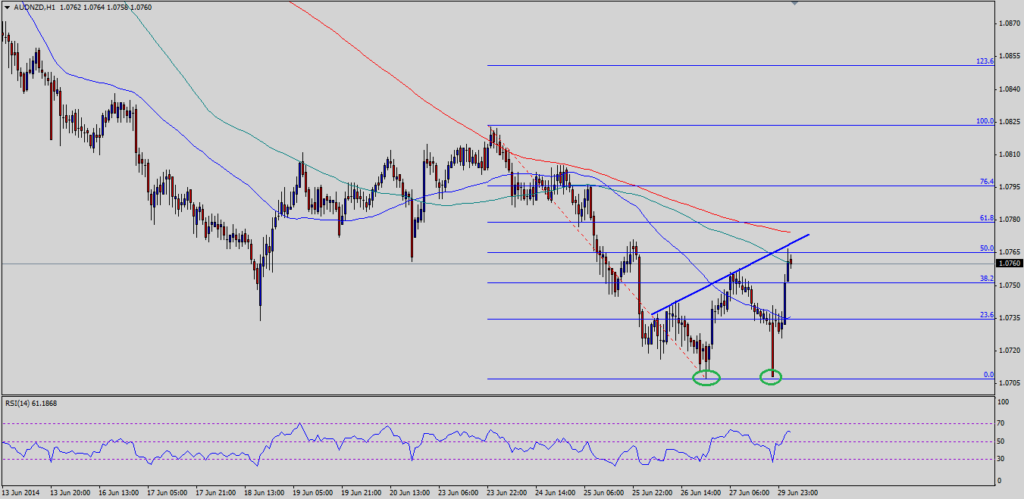

“¢ AUDNZD forms a double bottom pattern on the hourly timeframe.

“¢ A close above the 100 hourly SMA might take the pair higher.

“¢ AUDNZD support seen at 1.0735 and resistance ahead at 1.0770.

Australian dollar struggled to hold the downside against the New Zealand dollar this past week, but it looks like that the AUDNZD pair is starting to find buyers around 1.070 support level which might take it higher moving ahead.

Technical Analysis

The AUDNZD pair fell twice towards the 1.070 support levels and bounced, which means that the pair has formed a double bottom pattern on the hourly timeframe. If this pattern turns out not to be false one, then the pair can climb in the coming sessions. Currently, the pair is struggling around an important resistance confluence area of 100 hourly simple moving average and 50% Fibonacci retracement level of the last leg lower from the 1.0823 high to 1.0707 low. There is even a bearish trend line coinciding around the same resistance zone. So, the Australian dollar buyers might struggle to break the mentioned resistance confluence area. A break and close above the 100 hourly SMA could expose a run towards the last high of 1.0820 to complete the double bottom pattern.

False Move?

If the pair fails to break the mentioned resistance zone, then it might dive back towards the last low of 1.070. In that situation, it would be interesting to see whether buyers can hold the support level again or not. A break below would negate the pattern and might ignite more losses in the AUDNZD pair.

ANZ Business Confidence

Earlier during the Asian session, the ANZ Business Confidence was released by the ANZ. The outcome was a disappointing one, as the report mentioned that business confidence and other survey measures are sliding. A net 43% of firms are optimistic about general prospects; while it’s down 11 points this month, and 28 points off its peak, according to the report. This resulted in a decline in the New Zealand dollar and took the AUDNZD pair higher.