Draghi talks about action in March and talks about new downside risks. They may reconsider monetary policy in March. The measures announced in December were appropriate, says the president of the ECB. Emerging markets, volatile financial markets and a sluggish pace of reforms all create worries. There are heightened uncertainties about the global economy. The risks have risks on global growth, exports and confidence.

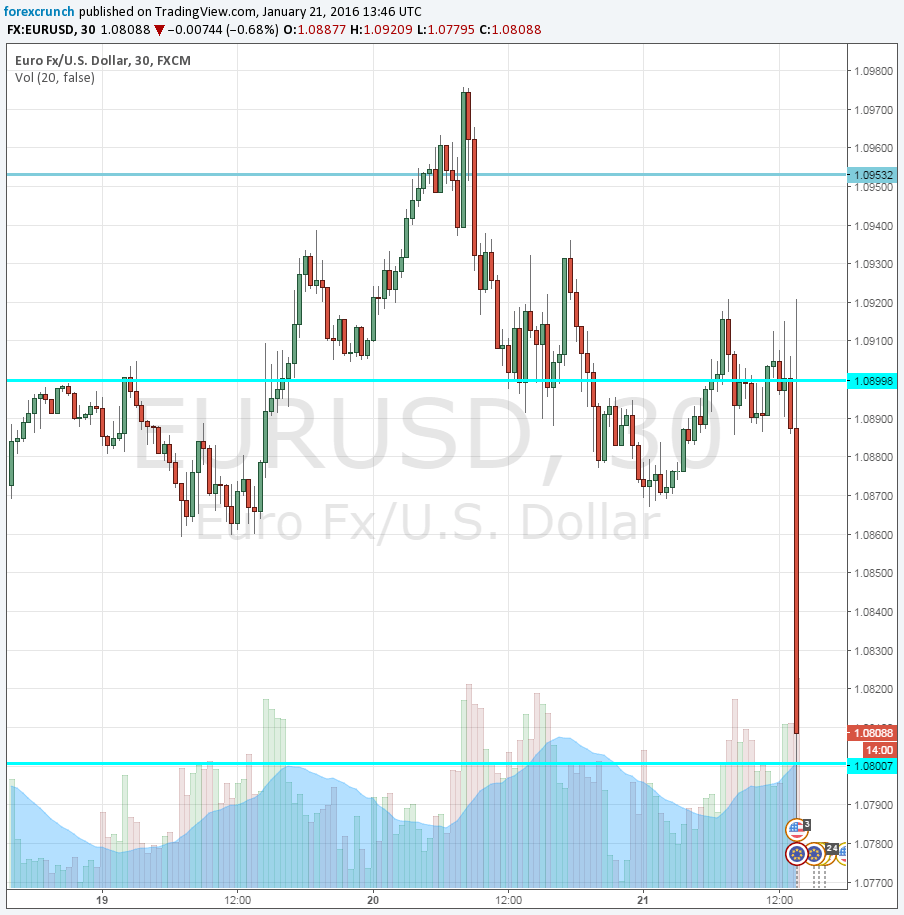

EUR/USD crashes towards support at 1.08.

- Inflation is low due to oil – it is down 40% since the last cut off for the ECB projections.

- Expected path of HICP is significantly lower because of oil.

- Inflation could be negative and recover later.

- Secondary effects should be monitored closely

- Emerging markets create huge worries

- In March, we will have new forecasts and may act.

- Draghi reiterates March action on the cards.

- Unanimous stance in the governing council regarding the communication today.

- The ECB’s credibility is in danger if were not ready to act.

- No doubt on our willingness to act.

- Closely watching China. It is contributing to downside risks. But, they are gaining control over policy making.

- Worried about secondary effects of falling oil and not seeing a rise in wages. Oil has a wide impact and not alone.

- Pretty clear that our actions have an impact on the exchange rate.

- Making technical preparations for action in March, but everything depends on the new forecasts.

EUR/USD falls over 100 pips to a new low of 1.0780.

Draghi’s task is to keep the euro down while not promising too much and not meeting his own expectations, like in December.

Follow the live coverage with Valeria Bednarik, Dale Pinkert and Mauricio Carrillo here:

(If you can not see or type in the chat box please go here)

On one hand, inflation is down, oil prices will send it lower and the Chinese slowdown looms. On the other hand, the ECB has already done a lot, its tools are becoming limited and internal opposition from the Germans is mounting.